Group Management Report

44

Products

76

Safety

80

Environment

84

Human Ressources

89

Social

Commitment

93

Consolidated Financial

Statements

97

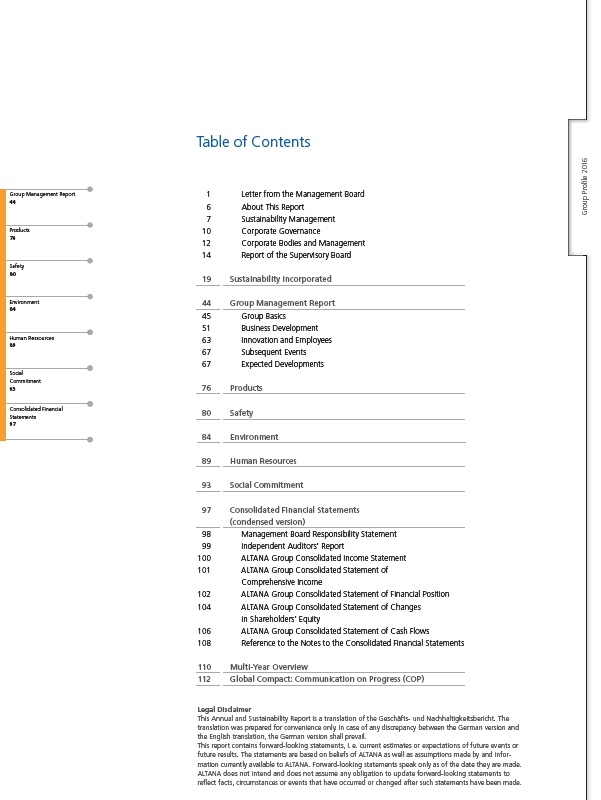

Table of Contents

Letter from the Management Board

About This Report

Sustainability Management

Corporate Governance

Corporate Bodies and Management

Report of the Supervisory Board

Sustainability Incorporated

Group Management Report

Group Basics

Business Development

Innovation and Employees

Subsequent Events

Expected Developments

Products

Safety

Environment

Human Resources

Social Commitment

Consolidated Financial Statements

(condensed version)

Management Board Responsibility Statement

Independent Auditors’ Report

ALTANA Group Consolidated Income Statement

ALTANA Group Consolidated Statement of

Comprehensive Income

ALTANA Group Consolidated Statement of Financial Position

ALTANA Group Consolidated Statement of Changes

in Shareholders’ Equity

ALTANA Group Consolidated Statement of Cash Flows

Reference to the Notes to the Consolidated Financial Statements

Multi-Year Overview

Global Compact: Communication on Progress (COP)

1

6

7

10

12

14

19

44

45

51

63

67

67

76

80

84

89

93

97

98

99

100

101

102

104

106

108

110

112

Legal Disclaimer

This Annual and Sustainability Report is a translation of the Geschäfts- und Nachhaltigkeitsbericht. The

translation was prepared for convenience only. In case of any discrepancy between the German version and

the English translation, the German version shall prevail.

This report contains forward-looking statements, i. e. current estimates or expectations of future events or

future results. The statements are based on beliefs of ALTANA as well as assumptions made by andinformation

currently available to ALTANA. Forward-looking statements speak only as of the date they are made.

ALTANA does not intend and does not assume any obligation to update forward-looking statements to

refl ect facts, circumstances or events that have occurred or changed after such statements have been made.

Group Profi le 2016

Key figures at a glance

2015 2016 %

in € million

Sales 2,059.3 2,075.3 1

Earnings before interest, taxes, depreciation and amortization (EBITDA) 390.9 453.0 16

EBITDA margin 19.0 % 21.8 %

Operating income (EBIT) 251.3 328.7 31

EBIT margin 12.2 % 15.8 %

Earnings before taxes (EBT) 227.8 299.8 32

EBT margin 11.1 % 14.4 %

Net income (EAT) 158.0 210.1 33

EAT margin 7.7 % 10.1 %

Research and development expenses 128.1 129.3 1

Capital expenditure on intangible assets and property, plant and equipment 85.6 122.1 43

Cash Flow from operating activities 346.1 376.7 9

Return on capital employed (ROCE) 10.1 % 11.6 %

ALTANA Value Added (AVA) 49.2 83.3 69

Dec. 31, 2015 Dec. 31, 2016 %

in € million

Total assets 2,964.5 3,053.9 3

Shareholders’ equity 1,935.6 2,082.2 8

Net debt (-) / Net financial assets (+) ¹ (114.2) 25.7 N / A

Headcount 6,096 5,967 - 2

¹ Comprises cash and cash equivalents, short-term financial assets, marketable securities, debt, and employee benefit obligations.

Due to rounding, this Annual and Sustainability Report may contain minor differences between single values, and sums or percentages.