54 Business Development

A main reason for this decrease was the ongoing reduction

of oil and gas exploration activities. In the course of the

year, the development of new wells declined again due to

the lower crude oil prices compared to the previous year.

Furthermore, U.S. customers’ demand for our products and

services was weaker, particularly in the first half of 2016.

In the second half of the year, however, the demand situation

improved steadily in the region. Sales in Brazil and

other

important

Latin American markets did not reach the

previous year’s levels. Overall, the Americas accounted

for 28 % of global Group sales in 2016 (previous year:

29 %).

In 2016, Asia was responsible for 31 % of Group sales

(previous year: 30 %). Recording operating growth of

8 %, Asia was the biggest growth driver of all the regions in

the past fiscal year. With operating growth amounting

to 11 %, the development of sales in China was particularly

strong. And with a 16 % share of total sales, China is

the Group’s second-largest sales market. Other Asian countries

also made positive contributions to the sales growth,

most notably India and Japan with growth rates of 9 % and

15 % respectively.

Sales Performance of BYK Additives & Instruments

In 2016, the BYK division increased its sales by 4 %, or

€ 39.1 million, to € 909.1 million (previous year: € 870.0 million).

However, the sales growth due to the integration

of the Addcomp companies was offset by slightly negative

exchange-rate effects. Adjusted for these effects, the

operating

sales growth was also 4 %.

In the course of the year, BYK benefitted from sales

shifts to higher-priced products. But the sales volume hardly

changed in a year-to-year comparison. A decrease in de-

mand for rheology additives, which are used, among other

things, in oil and gas exploration activities, was compen-

sated for by a positive development in other fields of business.

The division’s strongest sales segment, additives for the

coatings and paint industry, successfully expanded its business

activities. In addition, the demand for the division’s mea-

suring and testing instruments was above average.

In terms of regions, the division’s growth was driven by

Asia, and especially by growing demand among customers

in BYK’s second-largest sales market, China. Substantial sales

growth was also generated in other important Asian coun-

tries, most notably in Japan and India. Sales in Europe did not

grow at the same pace as the Asian growth region. But

BYK was able to record growing demand in all of the important

European markets. Only in Great Britain and a few

other small sales markets did sales fail to reach the previous

year’s level. Sales decreased in the Americas, dropping

most significantly in our largest single market, the U.S. The

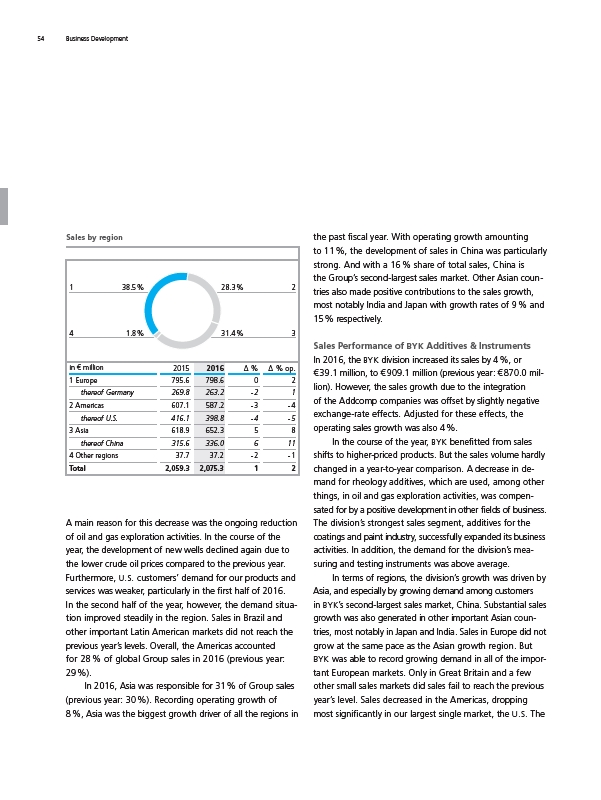

Sales by region

1

4

2

3

28.3 %

31.4 %

38.5 %

1.8 %

in € million 2015 2016 Δ % Δ % op.

1 Europe 795.6 798.6 0 2

thereof Germany 269.8 263.2 - 2 1

2 Americas 607.1 587.2 - 3 - 4

thereof U.S. 416.1 398.8 - 4 - 5

3 Asia 618.9 652.3 5 8

thereof China 315.6 336.0 6 11

4 Other regions 37.7 37.2 - 2 - 1

Total 2,059.3 2,075.3 1 2