Group Management Report Products Safety Environment Human Resources Social Commitment Consolidated Financial Statements 59

Another large investment involved a facility for carrying

out automated product analyses for additives at the Wesel site.

The investment volume in the ECKART division was

€ 17.2 million (previous year: € 19.3 million) and thus below

the previous year’s figure. Due to ongoing worldwide ef-

forts to make the ERP systems uniform, a not insignificant

portion of the total amount was invested in software.

The ELANTAS division invested significantly more in

property, plant and equipment and intangible assets than in

the previous year (€ 30.9 million in 2016 compared to

€ 10.7 million in 2015). More than half of the total capital

expenditure was allocated to the division’s sites in China,

by far ELANTAS’ biggest sales market. The acquisition of a

production site in Tongling was the most important indi-

vidual project.

The ACTEGA division also invested more than in the previous

year (€ 18.4 million in 2016 compared to € 12.0 million

in the previous year). Important individual projects were

the expansion of research and development capacities at

its Grevenbroich site and the purchase of a new extruder for

the manufacture of sealants. In addition, a new ERP system

was introduced at the division’s Lehrte site.

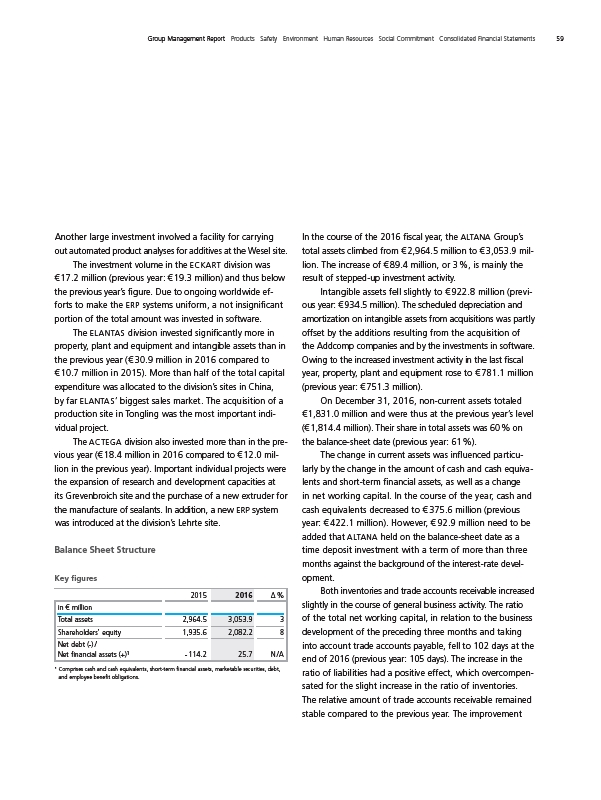

Balance Sheet Structure

Key figures

2015 2016 Δ %

in € million

Total assets 2,964.5 3,053.9 3

Shareholders’ equity 1,935.6 2,082.2 8

Net debt (-) /

Net financial assets (+)¹ - 114.2 25.7 N / A

¹ Comprises cash and cash equivalents, short-term financial assets, marketable securities, debt,

and employee benefit obligations.

In the course of the 2016 fiscal year, the ALTANA Group’s

total assets climbed from € 2,964.5 million to € 3,053.9 million.

The increase of € 89.4 million, or 3 %, is mainly the

result of stepped-up investment activity.

Intangible assets fell slightly to € 922.8 million (previous

year: € 934.5 million). The scheduled depreciation and

amortization on intangible assets from acquisitions was partly

offset by the additions resulting from the acquisition of

the Addcomp companies and by the investments in software.

Owing to the increased investment activity in the last fiscal

year, property, plant and equipment rose to € 781.1 million

(previous year: € 751.3 million).

On December 31, 2016, non-current assets totaled

€ 1,831.0 million and were thus at the previous year’s level

(€ 1,814.4 million). Their share in total assets was 60 % on

the balance-sheet date (previous year: 61 %).

The change in current assets was influenced particu-

larly by the change in the amount of cash and cash equivalents

and short-term financial assets, as well as a change

in net working capital. In the course of the year, cash and

cash equivalents decreased to € 375.6 million (previous

year: € 422.1 million). However, € 92.9 million need to be

added that ALTANA held on the balance-sheet date as a

time deposit investment with a term of more than three

months against the background of the interest-rate devel-

opment.

Both inventories and trade accounts receivable increased

slightly in the course of general business activity. The ratio

of the total net working capital, in relation to the business

development of the preceding three months and taking

into account trade accounts payable, fell to 102 days at the

end of 2016 (previous year: 105 days). The increase in the

ratio of liabilities had a positive effect, which overcompensated

for the slight increase in the ratio of inventories.

The relative amount of trade accounts receivable remained

stable compared to the previous year. The improvement