60 Business Development

of the net working capital ratios was in line with the development

forecast at the beginning of 2016. Total current

assets climbed by 6 % to € 1,222.8 million (previous year:

€ 1,150.1 million).

On the liabilities side, changes arose primarily due to

the repayment of promissory note loans (German Schuldscheine)

and the earnings-related increase in equity. Liabilities

from promissory note loans were reduced on account of

the scheduled repayment of one tranche (€ 42.5 million) and

the termination of variable tranches (€ 83.5 million). As a

result, non-current liabilities decreased to € 564.2 million (pre-

vious year: € 633.4 million). The reduction of debt was part-

ly offset by an increase in employee benefit obligations. The

share of total non-current liabilities fell from 21 % to 19 %.

Total current liabilities increased slightly from € 395.4 million

to € 407.5 million on December 31, 2016. The in-

crease in trade accounts payable and current provisions was

almost completely offset by the decrease in current debt.

The Group’s shareholders’ equity was up by € 146.6 million,

or 8 %, to € 2,082.2 million (previous year: € 1,935.6 mil-

lion). The increase is due to the net income in the 2016 fiscal

year. The equity ratio climbed to 68 % on December 31,

2016 (previous year: 65 %).

The net financial assets, comprising the balance of cash

and cash equivalents, short-term financial assets, current

marketable securities, debt, and employee benefit obligations,

were € 25.7 million at the end of 2016 (previous year: net

financial debt of € 114.2 million).

Principles and Goals of Our Financing Strategy

We generally aim to finance our operating business activities

from the cash flow from operating activities. The same

applies to the need for capital expenditure, which caters to

the continual expansion of business activities.

As a result, our financing strategy is oriented to keep-

ing the cash and cash equivalents generated within the Group

centralized. In addition, a financing framework is sought

that enables ALTANA to flexibly and quickly carry out acqui-

sitions and even large investment projects beyond the

accustomed scope.

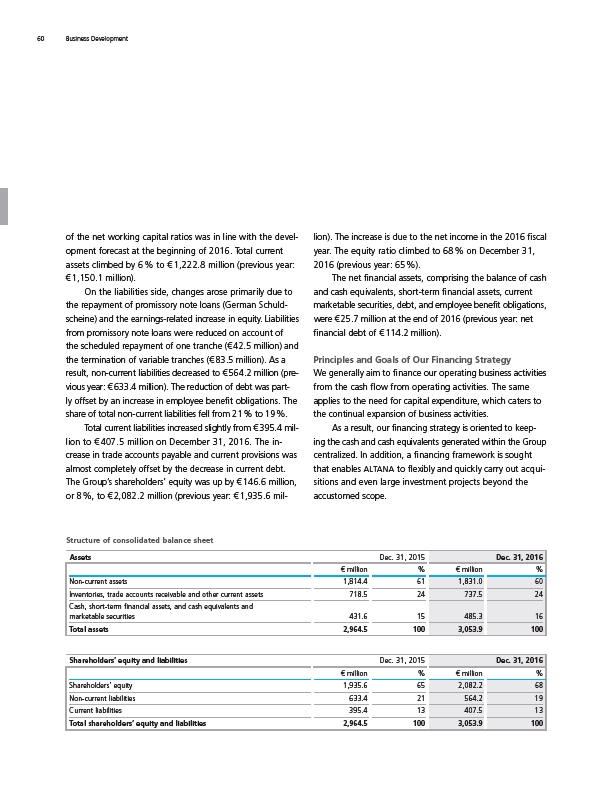

Structure of consolidated balance sheet

Assets Dec. 31, 2015 Dec. 31, 2016

€ million % € million %

Non-current assets 1,814.4 61 1,831.0 60

Inventories, trade accounts receivable and other current assets 718.5 24 737.5 24

Cash, short-term financial assets, and cash equivalents and

marketable securities 431.6 15 485.3 16

Total assets 2,964.5 100 3,053.9 100

Shareholders’ equity and liabilities Dec. 31, 2015 Dec. 31, 2016

€ million % € million %

Shareholders’ equity 1,935.6 65 2,082.2 68

Non-current liabilities 633.4 21 564.2 19

Current liabilities 395.4 13 407.5 13

Total shareholders’ equity and liabilities 2,964.5 100 3,053.9 100