Group Management Report Products Safety Environment Human Resources Social Commitment Consolidated Financial Statements 61

To successfully implement these goals, we manage nearly all

of the Group’s internal financing centrally via ALTANA AG.

To this end, cash pools for all of the important currency areas

have been set up.

At the end of 2016, ALTANA’s liabilities totaled € 224 mil-

lion due to the issuance of two promissory note loans in

2012 and 2013 (€ 350 million in total). The outstanding prom-

issory note loans are divided into tranches with fixed inter-

est rates and different maturities. The loans will be repaid by

2020. Furthermore, there is a general syndicated credit fa-

cility of € 250 million. The term of this credit facility will last

until at least 2021.

This financing structure offers ALTANA the flexibility

it needs to appropriately take advantage of short-term or

investment-intensive growth opportunities. The distribu-

tion of the maturities of the financing instruments we use

enables us to optimally control repayment of liabilities with

inflows from operating cash flow.

We continue to use off-balance-sheet financing instru-

ments to a very limited extent. These include purchasing

commitments, operating leasing commitments, and guaran-

tees for pension plans. Details on the existing financing

instruments are provided in the online Consolidated Financial

Statements.

Liquidity Analysis

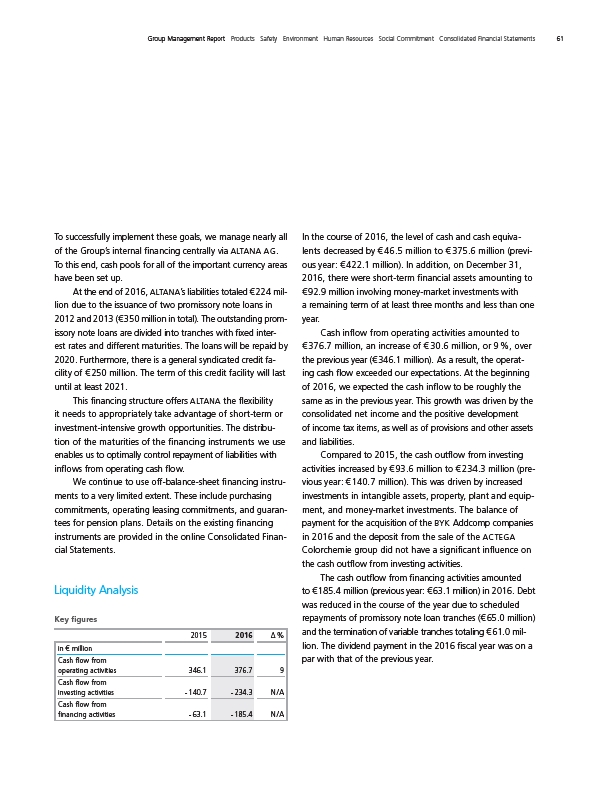

Key figures

2015 2016 Δ %

in € million

Cash flow from

operating activities 346.1 376.7 9

Cash flow from

investing activities - 140.7 - 234.3 N / A

Cash flow from

financing activities - 63.1 - 185.4 N / A

In the course of 2016, the level of cash and cash equivalents

decreased by € 46.5 million to € 375.6 million (previous

year: € 422.1 million). In addition, on December 31,

2016, there were short-term financial assets amounting to

€ 92.9 million involving money-market investments with

a remaining term of at least three months and less than one

year.

Cash inflow from operating activities amounted to

€ 376.7 million, an increase of € 30.6 million, or 9 %, over

the previous year (€ 346.1 million). As a result, the operat-

ing cash flow exceeded our expectations. At the beginning

of 2016, we expected the cash inflow to be roughly the

same as in the previous year. This growth was driven by the

consolidated net income and the positive development

of income tax items, as well as of provisions and other assets

and liabilities.

Compared to 2015, the cash outflow from investing

activities increased by € 93.6 million to € 234.3 million (pre-

vious year: € 140.7 million). This was driven by increased

investments in intangible assets, property, plant and equip-

ment, and money-market investments. The balance of

payment

for the acquisition of the BYK Addcomp companies

in 2016 and the deposit from the sale of the ACTEGA

Colorchemie group did not have a significant influence on

the cash outflow from investing activities.

The cash outflow from financing activities amounted

to € 185.4 million (previous year: € 63.1 million) in 2016. Debt

was reduced in the course of the year due to scheduled

repayments of promissory note loan tranches (€ 65.0 million)

and the termination of variable tranches totaling € 61.0 mil-

lion. The dividend payment in the 2016 fiscal year was on a

par with that of the previous year.