Group Management Report Products Safety and Health Environment Human Resources Social Commitment Consolidated Financial Statements 55

2019 and a slightly negative influence on earnings devel-

opment. The average exchange rate of the euro to the U.S.

dollar was 1.12 U.S. dollars for one euro, down on the

previous year (1.18 U.S. dollars for one euro). Effects from

changed exchange-rate relations also resulted from a further

decline in the average exchange rate of the euro against

the Chinese renminbi, from 7.81 renminbi to 7.74 ren-

minbi for one euro. Other currencies important for key business

figures also changed in relation to the Group currency,

the euro, on average over the year. The effects of the translation

of the financial statements of major non-euro Group

companies on items of the 2019 income statement were positive

overall. Differences in exchange rates on the balance

sheet date also had a positive influence on balance sheet

items compared to the previous year.

Business Performance

Group Sales Performance

Group sales reached a total of € 2,248.9 million in 2019,

a 3 % or € 58.5 million decrease compared to the previous

year (€ 2,307.4 million). Non-operating effects generally

had a positive effect on the sales development. Exchange-rate

changes, primarily from the changed relations of the euro

to the U.S. dollar, resulted in a sales increase of 1 %. Due to

the acquisition of the business of Paul N. Gardner in the

U.S. (BYK division) in mid-2019, Group sales increased by

€ 4.1 million. Adjusted for these currency and acquisition

effects, Group sales were 4 % below the previous year.

This means that we did not achieve the operating sales

growth in a range between 1 % and 5 % forecast at

the beginning of the year for 2019. The main reasons for the

shortfall were sluggish demand from key industrial sec-

tors, especially the automotive industry, and the general economic

slowdown, especially in China. The decline is al-

most exclusively due to a demand-driven reduction in sales

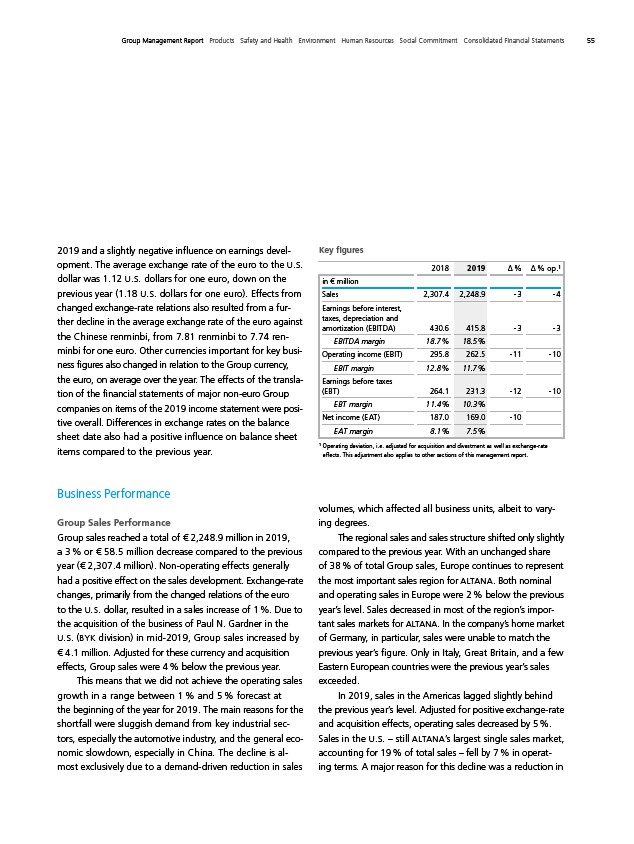

Key figures

2018 2019 Δ % Δ % op.¹

in € million

Sales 2,307.4 2,248.9 - 3 - 4

Earnings before interest,

taxes, depreciation and

amortization (EBITDA) 430.6 415.8 - 3 - 3

EBITDA margin 18.7 % 18.5 %

Operating income (EBIT) 295.8 262.5 - 11 - 10

EBIT margin 12.8 % 11.7 %

Earnings before taxes

(EBT) 264.1 231.3 - 12 - 10

EBT margin 11.4 % 10.3 %

Net income (EAT) 187.0 169.0 - 10

EAT margin 8.1 % 7.5 %

¹ Operating deviation, i. e. adjusted for acquisition and divestment as well as exchange-rate

effects. This adjustment also applies to other sections of this management report.

volumes, which affected all business units, albeit to varying

degrees.

The regional sales and sales structure shifted only slightly

compared to the previous year. With an unchanged share

of 38 % of total Group sales, Europe continues to represent

the most important sales region for ALTANA. Both nominal

and operating sales in Europe were 2 % below the previous

year’s level. Sales decreased in most of the region’s impor-

tant sales markets for ALTANA. In the company’s home market

of Germany, in particular, sales were unable to match the

previous year’s figure. Only in Italy, Great Britain, and a few

Eastern European countries were the previous year’s sales

exceeded.

In 2019, sales in the Americas lagged slightly behind

the previous year’s level. Adjusted for positive exchange-rate

and acquisition effects, operating sales decreased by 5 %.

Sales in the U.S. – still ALTANA’s largest single sales market,

accounting for 19 % of total sales – fell by 7 % in operat-

ing terms. A major reason for this decline was a reduction in