gation from an acquisition. On the other hand, the result of

companies accounted for using the at-equity method

worsened, from € - 24.5 million in the previous year to € - 39.1

million in the 2019 fiscal year. This was due to the higher

annual losses of the Israeli Landa Corporation Ltd. as a result

of the planned higher expenditure for future digital-print-

ing solutions in 2019 in the course of the market launch that

had already begun. This was compounded by the first-time

recognition of depreciation and amortization of the development

expenses identified at the time of acquisition.

Earnings before taxes (EBT) fell to € 231.3 million (previous

year: € 264.1 million), and earnings after taxes (EAT)

to € 169.0 million (previous year: € 187.0 million). As a consequence,

income tax was below the previous year’s level

due to the earnings decline. In addition, the income tax burden

was positively influenced by tax income received from

tax mutual agreement procedures.

Asset and Financial Situation

Capital Expenditure

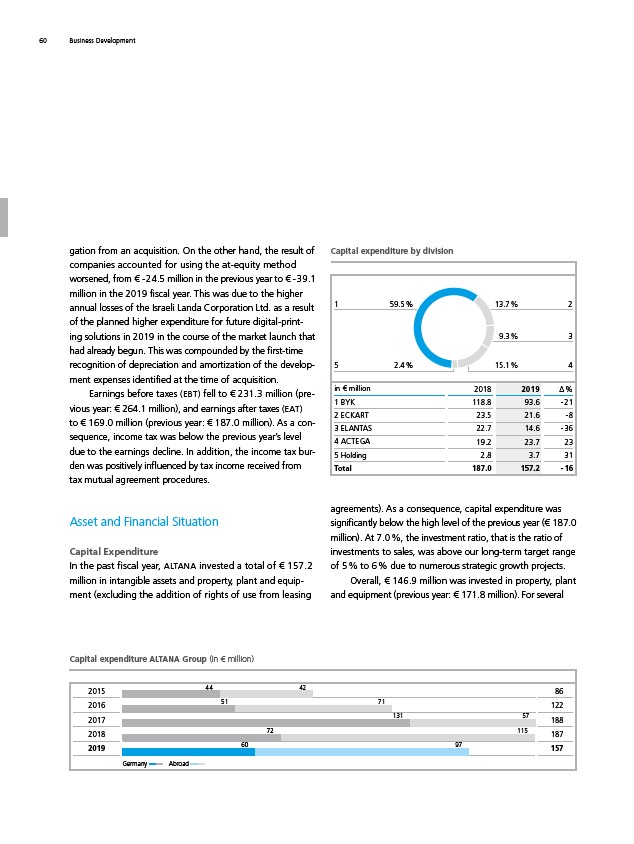

In the past fiscal year, ALTANA invested a total of € 157.2

million in intangible assets and property, plant and equipment

(excluding the addition of rights of use from leasing

Capital expenditure by division

1

2

3

agreements). As a consequence, capital expenditure was

significantly below the high level of the previous year (€ 187.0

million). At 7.0 %, the investment ratio, that is the ratio of

investments to sales, was above our long-term target range

of 5 % to 6 % due to numerous strategic growth projects.

Overall, € 146.9 million was invested in property, plant

and equipment (previous year: € 171.8 million). For several

4

13.7 %

9.3 %

59.5 %

5 2.4 % 15.1 %

in € million 2018 2019 Δ %

1 BYK 118.8 93.6 - 21

2 ECKART 23.5 21.6 - 8

3 ELANTAS 22.7 14.6 - 36

4 ACTEGA 19.2 23.7 23

5 Holding 2.8 3.7 31

Total 187.0 157.2 - 16

Capital expenditure ALTANA

Group (in € million)

2015 86

2016 122

2017 188

2018 187

2019 157

Germany Abroad

44 42

51 71

131 57

72 115

60 97

60 Business Development