Group Management Report Products Safety and Health Environment Human Resources Social Commitment Consolidated Financial Statements 61

years, major projects have been carried out for the strategic

expansion of production and laboratory capacities. Investments

in intangible assets reached € 10.3 million in the past

fiscal year, compared to € 15.2 million in 2018.

The regional distribution of investments did not change

significantly in the past fiscal year. The European share was

almost unchanged from 2018 at 49 % (previous year: 51%),

with the largest share in Europe attributable to German sites,

as in previous years. By contrast, the Americas recorded an

increase of 40 % in the 2019 fiscal year (previous year: 31 %),

while Asia’s share decreased to 11 % (previous year: 18 %).

In 2019, the BYK division invested a total of € 93.6

million, less than in the previous year (€ 118.8 million). As in

2018, the investment activity focused on the expansion

of manufacturing capacities for rheology additives in the U.S.

and on a site in China. In addition to research and development

capacities at various locations, other investments related

to a facility for carrying out automated product tests

on additives at the Wesel site and strategic digitalization projects.

At € 21.6 million (previous year: € 23.5 million), the

investment volume in the ECKART division was slightly lower

than in the previous year. By far the most significant

share was split equally between the division’s largest site in

Güntersthal and a site in the United States.

The ELANTAS division invested a significantly lower

amount in property, plant, and equipment and intangible assets

than in the previous year (€ 14.6 million compared to

€ 22.7 million in 2018). In the past fiscal year, the division in-

vested primarily at its sites in Italy and the U.S.

Investing € 23.7 million, the ACTEGA division’s capital

expenditure was at a higher level than in 2018 (€ 19.2 million).

Investments in the past fiscal year mainly related to

the expansion of manufacturing capacities and the construction

of a new innovation center at one of the division’s German

sites. More was also invested at the division’s U.S. and

Brazilian sites than in previous years.

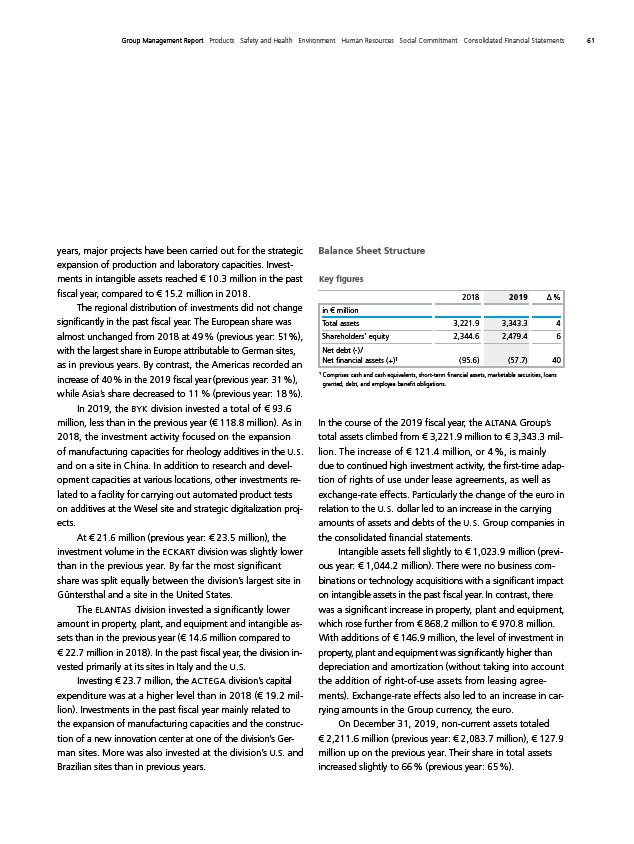

Balance Sheet Structure

Key figures

2018 2019 Δ %

in € million

Total assets 3,221.9 3,343.3 4

Shareholders’ equity 2,344.6 2,479.4 6

Net debt (-) /

Net financial assets (+)¹ ( 95.6) (57.7) 40

¹ Comprises cash and cash equivalents, short-term financial assets, marketable securities, loans

granted, debt, and employee benefit obligations.

In the course of the 2019 fiscal year, the ALTANA Group’s

total assets climbed from € 3,221.9 million to € 3,343.3 million.

The increase of € 121.4 million, or 4 %, is mainly

due to continued high investment activity, the first-time adaption

of rights of use under lease agreements, as well as

exchange-rate effects. Particularly the change of the euro in

relation to the U.S. dollar led to an increase in the carrying

amounts of assets and debts of the U.S. Group companies in

the consolidated financial statements.

Intangible assets fell slightly to € 1,023.9 million (previous

year: € 1,044.2 million). There were no business com-

binations or technology acquisitions with a significant impact

on intangible assets in the past fiscal year. In contrast, there

was a significant increase in property, plant and equipment,

which rose further from € 868.2 million to € 970.8 million.

With additions of € 146.9 million, the level of investment in

property, plant and equipment was significantly higher than

depreciation and amortization (without taking into account

the addition of right-of-use assets from leasing agreements).

Exchange-rate effects also led to an increase in carrying

amounts in the Group currency, the euro.

On December 31, 2019, non-current assets totaled

€ 2,211.6 million (previous year: € 2,083.7 million), € 127.9

million up on the previous year. Their share in total assets

increased slightly to 66 % (previous year: 65 %).