62 Business Development

The change in current assets was influenced particularly by

the decrease in net working capital. Both inventories and

trade accounts receivable fell in the past fiscal year as a result

of the decline in demand and the implementation of spe-

cific measures. The 6 % decrease in inventories to € 348.8 million

was due to a reduction in stocks of finished products

and a lower level of raw materials. The change in inventories

also had a significant impact on the development of total

net working capital. The balance of inventories, trade accounts

receivable, and trade accounts payable fell by € 14.8 mil-

lion to € 547.0 million. The ratio of net working capital, in

relation to the business development of the previous three

months, slightly decreased to 108 days, after 109 days at the

end of 2018, meaning that both the absolute net working

capital and the ratio developed in line with our expectations.

At the beginning of the year, we had forecast a change

in absolute net working capital in keeping with the general

business trend and a slight improvement in scope. Cash

and cash equivalents increased in the course of the year to

€ 264.6 million (previous year: € 239.7 million). Total current

assets fell slightly to € 1,131.7 million (previous year:

€ 1,138.1 million).

On the liabilities side, changes arose primarily due to

the earnings-related increase in equity. Group equity rose by

€ 134.8 million, or 6 %, to € 2,479.4 million (previous year:

€ 2,344.6 million). The increase is attributable to the surplus

in the 2019 financial year and, to a lesser extent, to positive

effects of exchange-rate fluctuations. The revaluation of net

pension obligations had a counteracting effect. The equity

ratio rose to 74 % on December 31, 2019 (previous year:

73 %).

The Group continued to report liabilities from promissory

note loans as an essential component of the debt at the

end of 2019. These liabilities were reduced further in the past

fiscal year by scheduled repayment of a tranche (€ 80.0 million)

and amounted to € 48.0 million at the end of the year,

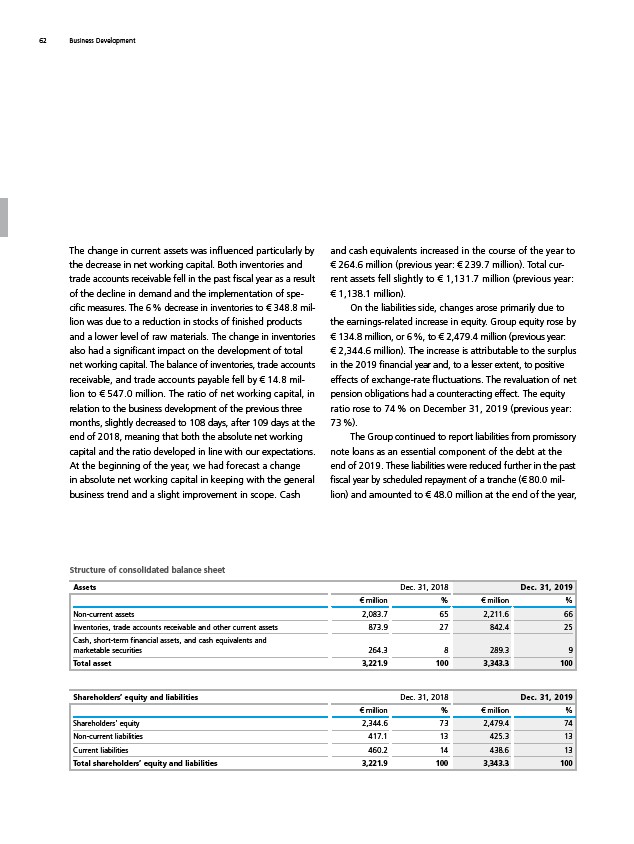

Structure of consolidated balance sheet

Assets Dec. 31, 2018 Dec. 31, 2019

€ million % € million %

Non-current assets 2,083.7 65 2,211.6 66

Inventories, trade accounts receivable and other current assets 873.9 27 842.4 25

Cash, short-term financial assets, and cash equivalents and

marketable securities 264.3 8 289.3 9

Total asset 3,221.9 100 3,343.3 100

Shareholders’ equity and liabilities Dec. 31, 2018 Dec. 31, 2019

€ million % € million %

Shareholders’ equity 2,344.6 73 2,479.4 74

Non-current liabilities 417.1 13 425.3 13

Current liabilities 460.2 14 438.6 13

Total shareholders’ equity and liabilities 3,221.9 100 3,343.3 100