activities was significantly higher than in the previous year

(€ 296.2 million), despite the lower Group net income. This

is primarily due to the fact that the funds tied up in

net working capital were reduced in the course of the year,

whereas in the previous year the balance of inventories,

trade accounts receivable, and trade accounts payable was

still increasing. The change in inventories was the main

driver of this development. In addition, a higher proportion

of net income in the past year was attributable to noncash

expenses.

Cash flow from investment activities rose to € 228.8 mil-

lion (previous year: € 195.7 million). Although investments

in intangible assets and property, plant and equipment were

at a lower level than in the previous year, the repayment

of a loan of € 71.0 million was made in the previous year and

expenditure on acquisitions in 2019 was higher than in

the previous year.

In the 2019 fiscal year, cash flow from financing activities

amounted to € 134.6 million and was thus at the previous

year’s level (€ 135.9 million). The current debt outflows

concerned the scheduled repayment of a promissory note

tranche totaling € 80.0 million and lease payments. In the

2019 fiscal year, ALTANA AG paid a dividend amounting

to € 50.0 million (previous year: € 80.0 million).

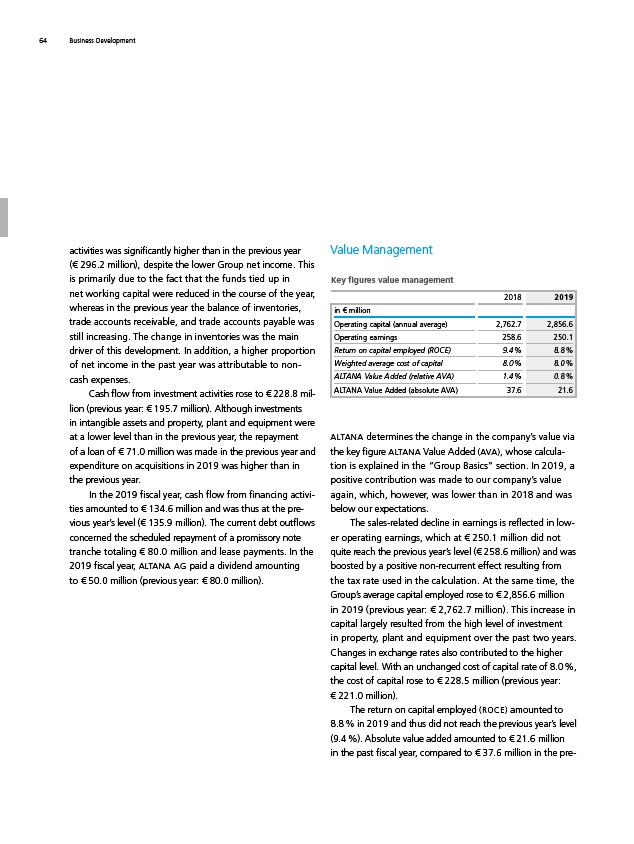

Value Management

Key figures value management

2018 2019

in € million

Operating capital (annual average) 2,762.7 2,856.6

Operating earnings 258.6 250.1

Return on capital employed (ROCE) 9.4 % 8.8 %

Weighted average cost of capital 8.0 % 8.0 %

ALTANA

Value Added (relative AVA) 1.4 % 0.8 %

ALTANA

Value Added (absolute AVA) 37.6 21.6

ALTANA determines the change in the company’s value via

the key figure ALTANA Value Added (AVA), whose calculation

is explained in the “Group Basics” section. In 2019, a

positive contribution was made to our company’s value

again, which, however, was lower than in 2018 and was

below our expectations.

The sales-related decline in earnings is reflected in lower

operating earnings, which at € 250.1 million did not

quite reach the previous year’s level (€ 258.6 million) and was

boosted by a positive non-recurrent effect resulting from

the tax rate used in the calculation. At the same time, the

Group’s average capital employed rose to € 2,856.6 million

in 2019 (previous year: € 2,762.7 million). This increase in

capital largely resulted from the high level of investment

in property, plant and equipment over the past two years.

Changes in exchange rates also contributed to the higher

capital level. With an unchanged cost of capital rate of 8.0 %,

the cost of capital rose to € 228.5 million (previous year:

€ 221.0 million).

The return on capital employed (ROCE) amounted to

8.8 % in 2019 and thus did not reach the previous year’s level

(9.4 %). Absolute value added amounted to € 21.6 million

in the past fiscal year, compared to € 37.6 million in the pre-

64 Business Development