Group Management Report Products Safety and Health Environment Human Resources Social Commitment Consolidated Financial Statements 55

ments of important non-euro Group companies on items of

the income statement were generally negative in 2018.

However, differences in exchange rates on the balance-sheet

date had a positive influence on the balance-sheet positions

compared to the previous year.

Business Performance

Group Sales Performance

Group sales amounted to € 2,307.4 million in 2018, a 3 %

or € 60.4 million increase over the previous year (€ 2,247.0

million). Non-operating effects generally had a positive

influence on the sales development. The acquisition of the

PolyAd companies (BYK division) in 2017 and the new

activities in the ELANTAS division acquired in the U.S. and

China resulted in a sales increase of 1 % over the previous

year due to the fact that they were included in the consolidated

financial statements for a full calendar year for the

first time. But the positive acquisition effects were more than

offset by burdens from exchange-rate changes. Sales

drops resulted primarily from the changed relations of the

euro to the U.S. dollar, to the Chinese renminbi, and to

the Brazilian real, amounting to 2 % in total. Adjusted for

these non-operating effects, operating sales grew by 4 %

in a year-to-year comparison. As a result, we achieved sales

growth within the 2 % to 5 % range we had anticipated

for 2018 at the beginning of the year.

The operating growth was driven almost exclusively

by higher sales prices and slightly positive product-mix effects.

The sales volume did not change much compared to 2017,

however. But these influences generally developed unevenly

within the Group.

The regional volume and sales structure shifted only

slightly vis-à-vis 2017. Accounting for 38 % of total Group

sales, as in the previous year, Europe continued to be

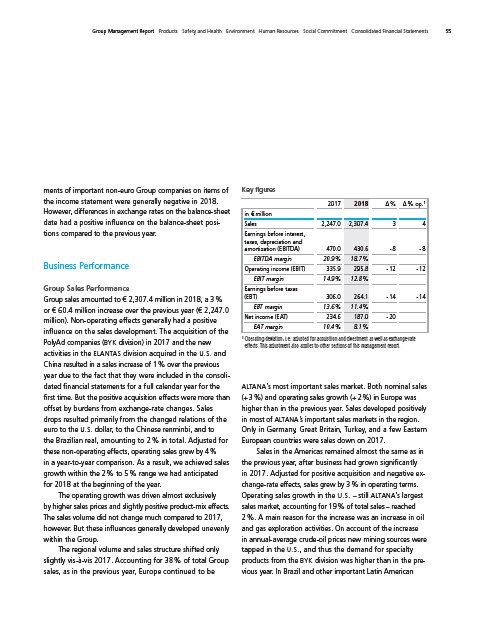

Key figures

2017 2018 Δ % Δ % op.¹

in € million

Sales 2,247.0 2,307.4 3 4

Earnings before interest,

taxes, depreciation and

amortization (EBITDA) 470.0 430.6 - 8 - 8

EBITDA margin 20.9 % 18.7 %

Operating income (EBIT) 335.9 295.8 - 12 - 12

EBIT margin 14.9 % 12.8 %

Earnings before taxes

(EBT) 306.0 264.1 - 14 - 14

EBT margin 13.6 % 11.4 %

Net income (EAT) 234.6 187.0 - 20

EAT margin 10.4 % 8.1 %

¹ Operating deviation, i. e. adjusted for acquisition and divestment as well as exchange-rate

effects. This adjustment also applies to other sections of this management report.

ALTANA’s most important sales market. Both nominal sales

(+ 3 %) and operating sales growth (+ 2 %) in Europe was

higher than in the previous year. Sales developed positively

in most of ALTANA’s important sales markets in the region.

Only in Germany, Great Britain, Turkey, and a few Eastern

European countries were sales down on 2017.

Sales in the Americas remained almost the same as in

the previous year, after business had grown significantly

in 2017. Adjusted for positive acquisition and negative exchange

rate effects, sales grew by 3 % in operating terms.

Operating

sales growth in the U.S. – still ALTANA’s largest

sales market, accounting for 19 % of total sales – reached

2 %. A main reason for the increase was an increase in oil

and gas exploration activities. On account of the increase

in annual-average crude-oil prices new mining sources were

tapped in the U.S., and thus the demand for specialty

products

from the BYK division was higher than in the previous

year. In Brazil and other important Latin American