The financial result was € - 7.2 million, an improvement over

2017 (€ - 8.6 million). The background for the improvement

was lower interest expenses resulting from the repayment of

promissory notes. On the other hand, the result of companies

accounted for using the at-equity method worsened, from

€ - 21.3 million in the previous year to € - 24.5 million in

the 2018 fiscal year. This decline is due to the fact that the

Israeli Landa Corp. recorded higher losses for the year.

The company’s 2018 fiscal year was burdened by the planned

higher expenditure in the course of preparations for the

broad-based market introduction of future digital-printing

solutions.

Earnings before taxes (EBT) dropped to € 264.1 million

(previous year: € 306.0 million), and net income (EAT) to

€ 187.0 million (previous year: € 234.6 million). Despite the

earnings decline, income tax surpassed the previous year’s

level. This is mainly due to the inclusion in the consolidated

financial statements of the one-time positive special effect

totaling € 20 million from the tax reform in the U.S. in the

previous year.

Asset and Financial Situation

Capital Expenditure

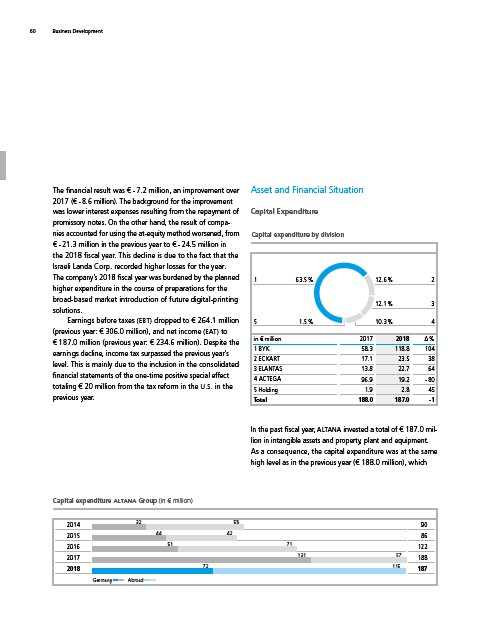

Capital expenditure by division

1

2

3

4

12.6 %

12.1 %

63.5 %

5 1.5 % 10.3 %

in € million 2017 2018 Δ %

1 BYK 58.3 118.8 104

2 ECKART 17.1 23.5 38

3 ELANTAS 13.8 22.7 64

4 ACTEGA 96.9 19.2 - 80

5 Holding 1.9 2.8 45

Total 188.0 187.0 - 1

In the past fiscal year, ALTANA invested a total of € 187.0 million

in intangible assets and property, plant and equipment.

As a consequence, the capital expenditure was at the same

high level as in the previous year (€ 188.0 million), which

Capital expenditure ALTANA

Group (in € million)

32 58

2014 90

2015 86

2016 122

2017 188

2018 187

Germany Abroad

131 57

44 42

51 71

72 115

60 Business Development