Group Management Report Products Safety and Health Environment Human Resources Social Commitment Consolidated Financial Statements 61

in 2017 was mainly influenced by the acquisition of the

metallography technology of the Israeli company Landa Labs.

The investment ratio, that is the ratio of investments to

sales, was 8.1 % due to strategic growth projects and thus

above our long-term target range of 5 % to 6 %.

Overall, € 171.8 million were invested in property,

plant and equipment (previous year: € 96.4 million). Starting

in 2017, large strategic projects were launched and

advanced that encompass the expansion of manufacturing

and laboratory capacities and that had a decisive influence

on the increase in the investment level. In the past fiscal year,

investments in intangible assets reached € 15.2 million,

after € 91.6 million in 2017. The high level in the previous

year is primarily a result of the acquisition of technology

from the Israeli company Landa Labs.

In the last fiscal year, the regional distribution of investments

changed significantly. The European share fell from

80 % to 51 %, and German sites again accounted for the

largest share. The Americas, however, recorded a signifi-

cant increase of 30 % (previous year: 14 %), while Asia’s share

also rose in the 2018 fiscal year, reaching 18 % (previous

year: 6 %).

In 2018, the BYK division invested a total of € 118.8 million,

about twice as much as in the previous year (€ 58.3

million). The investment activity focused on the expansion of

manufacturing capacities for rheology additives in the U.S.

as well as the building of a new site in Shanghai in order to

concentrate sales and research activities in China at one

site in the future. Further investments involved research and

development capacities at various sites as well as a facility

for carrying out automated product tests on additives at the

Wesel site.

The investment volume in the ECKART division was

€ 23.5 million, higher than in 2017 (previous year: € 17.1 million).

By far the largest share was invested in the division’s

biggest site in Güntersthal, followed by sites in the U.S. and

Switzerland.

The ELANTAS division invested € 22.7 million in property,

plant and equipment and intangible assets, more than in the

previous year (€ 13.8 million). In the past fiscal year the

focus of investment was on the division’s sites in the U.S.,

Italy, Germany, and India.

Investing € 19.2 million, the ACTEGA division’s capital

expenditure was at a much lower level than in 2017

(€ 96.9 million). But the decrease was due solely to the acquisition

in 2017 of the metallography activities and the

technology portfolio for labels and packaging in the U.S. The

capital expenditure in the past fiscal year mainly involved

investment in capacity expansions as well as research and

development labs at the division’s German sites.

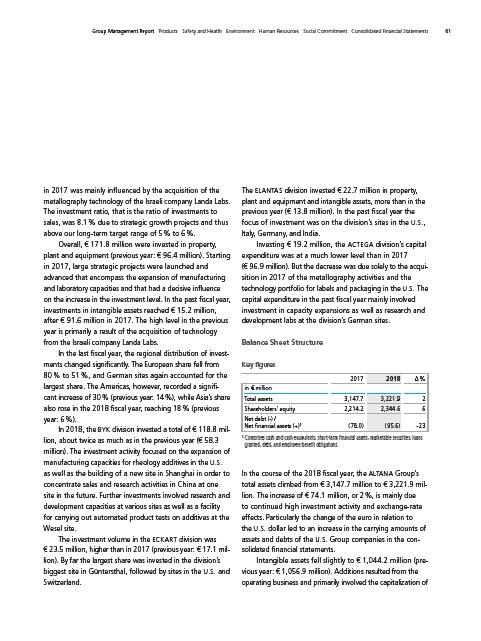

Balance Sheet Structure

Key figures

2017 2018 Δ %

in € million

Total assets 3,147.7 3,221.9 2

Shareholders’ equity 2,214.2 2,344.6 6

Net debt (-) /

Net financial assets (+)¹ ( 78.0) ( 95.6) - 23

¹ Comprises cash and cash equivalents, short-term financial assets, marketable securities, loans

granted, debt, and employee benefit obligations.

In the course of the 2018 fiscal year, the ALTANA Group’s

total assets climbed from € 3,147.7 million to € 3,221.9 million.

The increase of € 74.1 million, or 2 %, is mainly due

to continued high investment activity and exchange-rate

effects. Particularly the change of the euro in relation to

the U.S. dollar led to an increase in the carrying amounts of

assets and debts of the U.S. Group companies in the consolidated

financial statements.

Intangible assets fell slightly to € 1,044.2 million (previous

year: € 1,056.9 million). Additions resulted from the

operating business and primarily involved the capitalization of