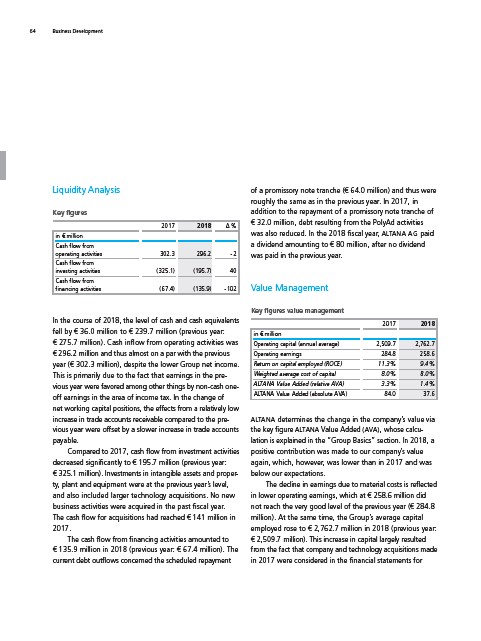

Liquidity Analysis

Key figures

2017 2018 Δ %

in € million

Cash flow from

operating activities 302.3 296.2 - 2

Cash flow from

investing activities ( 325.1) (195.7) 40

Cash flow from

financing activities ( 67.4) (135.9) - 102

In the course of 2018, the level of cash and cash equivalents

fell by € 36.0 million to € 239.7 million (previous year:

€ 275.7 million). Cash inflow from operating activities was

€ 296.2 million and thus almost on a par with the previous

year (€ 302.3 million), despite the lower Group net income.

This is primarily due to the fact that earnings in the pre-

vious year were favored among other things by non-cash oneoff

earnings in the area of income tax. In the change of

net working capital positions, the effects from a relatively low

increase in trade accounts receivable compared to the pre-

vious year were offset by a slower increase in trade accounts

payable.

Compared to 2017, cash flow from investment activities

decreased significantly to € 195.7 million (previous year:

€ 325.1 million). Investments in intangible assets and property,

plant and equipment were at the previous year’s level,

and also included larger technology acquisitions. No new

business activities were acquired in the past fiscal year.

The cash flow for acquisitions had reached € 141 million in

2017.

The cash flow from financing activities amounted to

€ 135.9 million in 2018 (previous year: € 67.4 million). The

current debt outflows concerned the scheduled repayment

of a promissory note tranche (€ 64.0 million) and thus were

roughly the same as in the previous year. In 2017, in

addition

to the repayment of a promissory note tranche of

€ 32.0 million, debt resulting from the PolyAd activities

was also reduced. In the 2018 fiscal year, ALTANA AG paid

a dividend amounting to € 80 million, after no dividend

was paid in the previous year.

Value Management

Key figures value management

2017 2018

in € million

Operating capital (annual average) 2,509.7 2,762.7

Operating earnings 284.8 258.6

Return on capital employed (ROCE) 11.3 % 9.4 %

Weighted average cost of capital 8.0 % 8.0 %

ALTANA

Value Added (relative AVA) 3.3 % 1.4 %

ALTANA

Value Added (absolute AVA) 84.0 37.6

ALTANA determines the change in the company’s value via

the key figure ALTANA Value Added (AVA), whose calculation

is explained in the “Group Basics” section. In 2018, a

positive contribution was made to our company’s value

again, which, however, was lower than in 2017 and was

below our expectations.

The decline in earnings due to material costs is reflected

in lower operating earnings, which at € 258.6 million did

not reach the very good level of the previous year (€ 284.8

million). At the same time, the Group’s average capital

employed rose to € 2,762.7 million in 2018 (previous year:

€ 2,509.7 million). This increase in capital largely resulted

from the fact that company and technology acquisitions made

in 2017 were considered in the financial statements for

64 Business Development