62 Business Development

customer relationships and software that had been acquired.

In the past fiscal year, there were no major business combinations

or technology acquisitions. On the other hand, property,

plant and equipment rose significantly, from € 774.4 million

to € 868.2 million. With additions of € 171.8 million,

the level of investment in property, plant and equipment was

significantly higher than depreciation and amortization.

Exchange

rate effects also led to an increase in the carrying

amount in the Group currency, the euro.

On December 31, 2018, non-current assets totaled

€ 2,083.7 million (previous year: € 2,021.6 million), € 62.1

million up on the previous year. Their share in total assets

was 65 % on the balance-sheet date (previous year: 64 %).

The change in current assets was influenced particularly

by the increase in net working capital and partially offset

by the decrease in the amount of cash and cash equivalents.

Both inventories and trade accounts receivable grew in

the past fiscal year. Inventories rose by 13 % to € 373.0 million,

primarily due to the higher raw-material volume as some

raw materials were purchased in larger quantities on

account of the very limited availability at times and the expected

price increases. This gave rise to an increase in the

ratio of the entire net working capital. The ratio, in relation

to the business development of the previous three months,

was 109 days and thus significantly higher than at the end

of 2017 (previous year: 101 days), surpassing our expectations.

At the beginning of the year we had forecast a slight

improvement of the ratio. As opposed to the ratio of

inventories, the ratios for trade accounts receivable and payable

basically developed stably. Total assets increased

slightly to € 1,138.1 million (previous year: € 1,126.1 million).

Cash and cash equivalents decreased in the course of

the year, mainly due to the continued high investments as

well as the repayment of a tranche of the promissory note

loan and the payment of dividends amounting to € 239.7 million

(previous year: € 275.7 million).

On the liabilities side, changes arose primarily due to

the earnings-related increase in equity. Group equity rose by

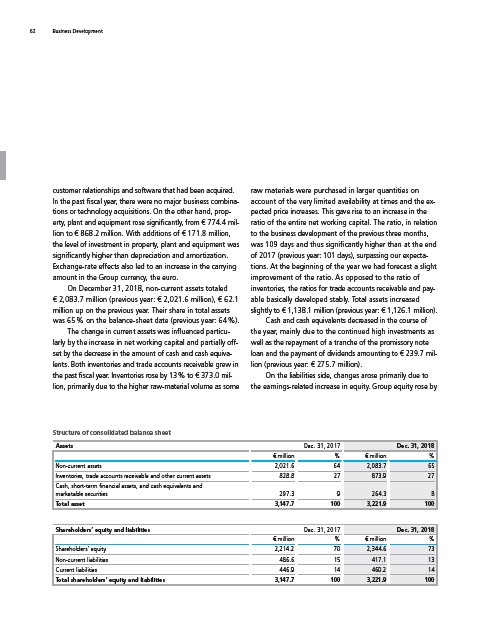

Structure of consolidated balance sheet

Assets Dec. 31, 2017 Dec. 31, 2018

€ million % € million %

Non-current assets 2,021.6 64 2,083.7 65

Inventories, trade accounts receivable and other current assets 828.8 27 873.9 27

Cash, short-term financial assets, and cash equivalents and

marketable securities 297.3 9 264.3 8

Total asset 3,147.7 100 3,221.9 100

Shareholders’ equity and liabilities Dec. 31, 2017 Dec. 31, 2018

€ million % € million %

Shareholders’ equity 2,214.2 70 2,344.6 73

Non-current liabilities 486.6 15 417.1 13

Current liabilities 446.9 14 460.2 14

Total shareholders’ equity and liabilities 3,147.7 100 3,221.9 100