Letter from the Management Board | About This Report | Sustainability Management | Corporate Governance | Corporate Bodies and Management | Report of the Supervisory Board | Creating Added Value at ALTANA | Group Management Report | Products | Safety and Health | Environment | Human Resources | Social Commitment | Consolidated Financial Statements (condensed version) | Multi-Year Overview | Global Compact: Communication on Progress (COP) | ALTANA worldwide | List of Full Ownership | Overview - About This Report | Contact

General Business Setting

Overall Economic Situation

The momentum of global economic development continued to slow down in the course of 2019. The International Monetary Fund (IMF) currently estimates that the world economy grew by 2.9 %, down on the previous year (3.6 %). The escalating trade conflict between the USA and China in 2019, the decline in demand in Asia, particularly in China, compared with previous years, and the uncertainties surrounding the United Kingdom’s withdrawal from the European Union exacerbated the already existing economic downturn. This trend is reflected in almost all regions, but especially in the established industrial nations. Only in Japan did the economy develop better than in the previous year.

At an expected 1.2 %, the Eurozone posted lower growth than in the previous year 2018 (1.9 %). All of the major economies in Europe exhibited a nearly parallel economic development characterized by flagging momentum. According to the International Monetary Fund (IMF), Germany’s economic growth was particularly subdued. At 0.5 %, it was significantly lower than in the previous year (1.5 %). In the two preceding years, the growth dynamics were more pronounced. Growth in 2019 was mainly supported by consumption. Private and public consumer spending grew more strongly than in the two previous years.

According to current IMF estimates, the economic momentum in the Americas in 2019 was also at a lower level than in 2018, with the USA reporting a decrease in economic growth from 2.9 % in the previous year to 2.3 % in 2019. The economic performance in Canada was also weaker, with an increase of 1.5 % (previous year: 1.9 %). Economic growth in the major Latin American economies remained at the same low level. At 1.2 %, the Brazilian economy in particular did not achieve higher growth than in the previous year (+ 1.3 %). Mexico, on the other hand, stagnated in 2019 (0 %), after posting growth of 2.1 % in the previous year.

Growth in Asia also slowed down in 2019, but was still at a high level compared to the other regions. With an expansion of 6.1 %, China did not reach the growth rate of 6.6 % of the previous year. The growth rate in India fell more significantly, from 6.8 % in the previous year to 4.8 % in 2019. The largest economies of Southeast Asia (ASEAN-5), which grew by 4.7 %, were also unable to match the growth of the previous year (5.2 %). In Japan, on the other hand, the increase in economic output accelerated from 0.3 % to 1.0 %.

Industry-Specific Framework Conditions

According to estimates by the American Chemistry Council (ACC), global chemical manufacture increased by 1.2 % in the past fiscal year, achieving slightly higher growth than in 2018 (1.0 %). As a result, the growth momentum in chemical production should increase, contrary to the trend in global economic output.

However, the regional changes in chemical production do not reflect the regional development of general economic performance in all countries. According to the German Chemical Industry Association (VCI), Europe’s largest chemical producer, Germany, again recorded a significant decline in production volume (excluding the pharmaceutical industry) of 2.5 % in 2019. On the other hand, the ACC estimates that other European countries that are important for the chemical industry recorded positive developments in chemical production, including the United Kingdom (+ 1.1 %), France (+ 0.9 %), and Italy (+ 0.6 %). In the entire European region, chemical production was down 0.4 % in a year-to-year comparison.

In the U.S., the increase in chemical production fell significantly to 0.6 % (previous year: 3.8 %), particularly due to the trade disputes between China and the USA. In Latin America, chemical production growth also decreased compared with the previous year, albeit at a significantly lower level.

The chemical sector in the Asia-Pacific region was again the biggest driver of global growth in the past fiscal year. The ACC estimates that production grew by 3.1 % in this region, after standing still in the previous year (0.1 %). The high momentum is mainly due to the development of chemical manufacture in China, which is expected to grow by 4.9 % in 2019, while growth in Korea and Japan was significantly lower than in the previous year.

In the first few months of 2019, the price of a barrel of Brent crude initially rose continuously from just under 55 U.S. dollars to 75 U.S. dollars. From June onwards, the price initially weakened noticeably and, due to fears of a further intensification of trade conflicts and the sluggish industrial economy, fell back to the level of the beginning of the year. Oil prices then rose sharply again in the course of December, closing the year at 67 U.S. dollars. One of the reasons for the increase was the announced breakthrough in the negotiations to defuse the trade dispute between the USA and China, which had previously repeatedly depressed oil prices. On an annual average, the price level in 2019 was thus below that of the previous year.

Important Events for Business Development

In 2019, non-operating effects influenced ALTANA’s earnings and financial position as well as its assets. In July 2019, ALTANA acquired the testing instruments and other laboratory equipment business of the American Paul N. Gardner Company, Inc. in an asset deal. The activities were integrated into the BYK division and had a slightly positive impact on the sales development. By contrast, the activities acquired at the end of 2019 in the wire enamel business of the Hubergroup India Private Ltd. did not yet make a sales or earnings contribution to the ELANTAS division in the past fiscal year.

The development of exchange rates between the euro, the Group currency, and other currencies important for ALTANA had a positive influence on sales development in 2019 and a slightly negative influence on earnings development. The average exchange rate of the euro to the U.S. dollar was 1.12 U.S. dollars for one euro, down on the previous year (1.18 U.S. dollars for one euro). Effects from changed exchange-rate relations also resulted from a further decline in the average exchange rate of the euro against the Chinese renminbi, from 7.81 renminbi to 7.74 renminbi for one euro. Other currencies important for key business figures also changed in relation to the Group currency, the euro, on average over the year. The effects of the translation of the financial statements of major non-euro Group companies on items of the 2019 income statement were positive overall. Differences in exchange rates on the balance sheet date also had a positive influence on balance sheet items compared to the previous year.

Group Sales Performance

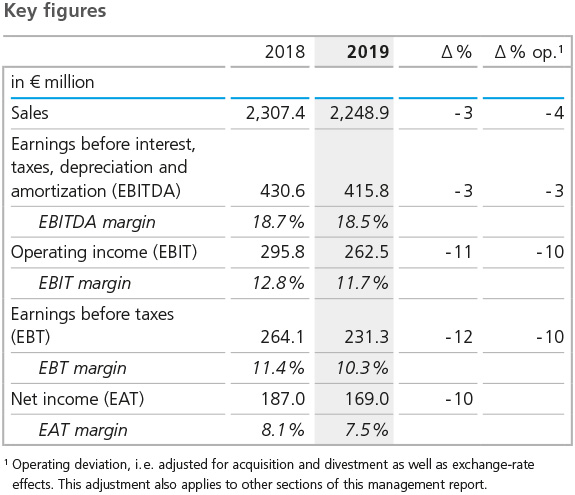

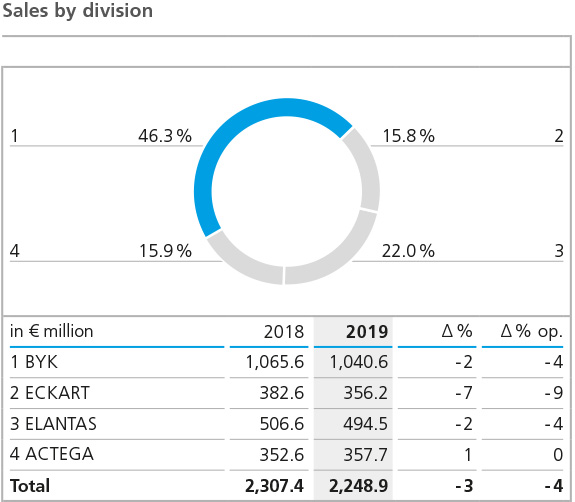

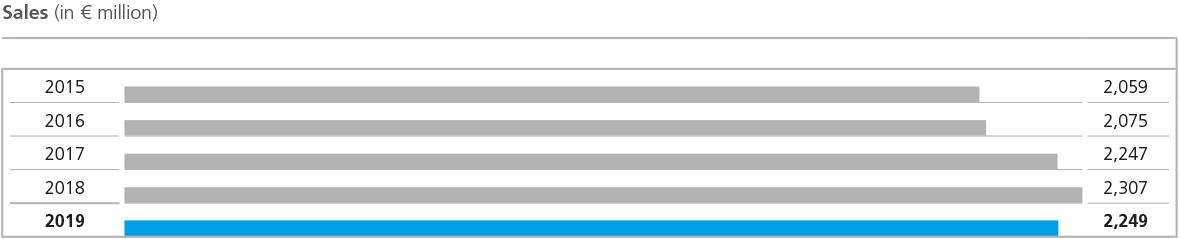

Group sales reached a total of € 2,248.9 million in 2019, a 3 % or € 58.5 million decrease compared to the previous year (€ 2,307.4 million). Non-operating effects generally had a positive effect on the sales development. Exchange-rate changes, primarily from the changed relations of the euro to the U.S. dollar, resulted in a sales increase of 1 %. Due to the acquisition of the business of Paul N. Gardner in the U.S. (BYK division) in mid-2019, Group sales increased by € 4.1 million. Adjusted for these currency and acquisition effects, Group sales were 4 % below the previous year.

This means that we did not achieve the operating sales growth in a range between 1 % and 5 % forecast at the beginning of the year for 2019. The main reasons for the shortfall were sluggish demand from key industrial sectors, especially the automotive industry, and the general economic slowdown, especially in China. The decline is almost exclusively due to a demand-driven reduction in sales volumes, which affected all business units, albeit to varying degrees.

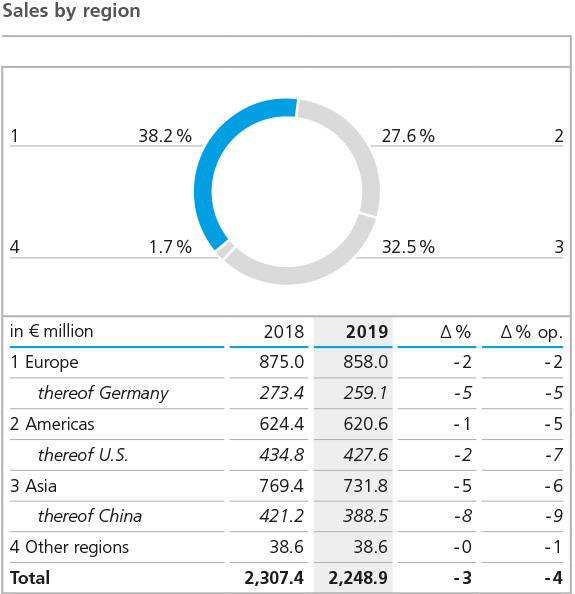

The regional sales and sales structure shifted only slightly compared to the previous year. With an unchanged share of 38 % of total Group sales, Europe continues to represent the most important sales region for ALTANA. Both nominal and operating sales in Europe were 2 % below the previous year’s level. Sales decreased in most of the region’s important sales markets for ALTANA. In the company’s home market of Germany, in particular, sales were unable to match the previous year’s figure. Only in Italy, Great Britain, and a few Eastern European countries were the previous year’s sales exceeded.

In 2019, sales in the Americas lagged slightly behind the previous year’s level. Adjusted for positive exchange-rate and acquisition effects, operating sales decreased by 5 %. Sales in the U.S. – still ALTANA’s largest single sales market, accounting for 19 % of total sales – fell by 7 % in operating terms. A major reason for this decline was a reduction in exploration activities. As a result of the lower average crudeoil price level over the year, the development of new production sources in the U.S. declined, and so demand for the corresponding special products of the BYK division fell significantly compared to the previous year. In Brazil and other major Latin American markets, however, operating sales grew slightly vis-à-vis the previous year. Overall, the Americas’ share of Group sales increased slightly to 28 % (previous year: 27 %). Asia continued to account for 33 % of Group sales in the past fiscal year. In operational terms, however, sales did not reach the level of 2018, down by 6 %. The significantly weaker economic growth in China, in particular, resulted in a decrease in demand for the Group’s products and services in the region. With a sales share of 17 % (previous year: 18 %), China remains ALTANA’s second largest market.

Sales Performance of BYK

In the 2019 fiscal year, sales in the BYK division dropped by 2 % or € 25.0 million to € 1,040.6 million (previous year: € 1,065.6 million). This includes positive exchange-rate changes as well as acquisition effects due to the acquisition of the business activities of Paul N. Gardner in the U.S. in the middle of the year. Adjusted for these two effects, operating sales were 4 % down on the previous year.

In 2019, BYK recorded lower sales in almost all markets and regions. The effects of the fundamentally difficult overall economic environment and, in particular, the weak demand in the automotive industry were reflected in a significant year-to-year decline in demand. A significant portion of the sales decline is attributable to the division’s business with additives for the plastics industry and reduced demand in the oil and gas sector due to the drop in crude oil prices over the course of the year. In contrast, the previous year’s sales of measuring and testing instruments were slightly exceeded thanks to the acquisition made in mid-2019.

In terms of regions, Asia and the Americas were particularly affected by the operating sales decrease. Developments in Asia were negatively impacted above all by the significant decline in operating sales in China, BYK’s second largest single market. This could not be offset by slight operating sales growth in some Asian countries, including India and Thailand. Sales in the Americas also declined in operating terms. Sales fell noticeably, particularly in the U.S., the division’s largest single market. In Brazil, by contrast, sales were at the prior-year level. Adjusted for positive exchange-rate and acquisition effects, the Americas region, similar to Asia, showed an overall downward trend compared with the previous year. In contrast, sales in Europe dropped only slightly. A significant decline, particularly in Germany, was partially offset by growth in other major markets on the continent such as the UK, Italy, and Turkey.

Sales Performance of ECKART

In 2019, the ECKART division generated sales of € 356.2 million (previous year: € 382.6 million). The 7 % decline vis-à-vis the previous year was influenced by positive exchange-rate effects. Adjusted for these effects, operating sales fell by 9 %. Of this, 3 percentage points were attributable to the discontinuation of low-margin trading business in China. The sales trend in the division’s core business was slowed in particular by declining demand in the automotive industry, as well as in other industrial sectors.

The fundamentally difficult market environment was reflected in almost all regions in 2019. In China, the division’s complete withdrawal from trade business in 2019 left a clear mark on sales development. In combination with fundamentally declining growth in the Chinese market, sales in Asia were below the previous year’s level. Sales in the Americas were also well below 2018. Weak sales in Germany had a negative impact on ECKART’s business activities in Europe, although not quite as significant as in Asia and the Americas.

Sales Performance of ELANTAS

In the ELANTAS division, sales in 2019 fell by 2 % or € 12.0 million to € 494.5 million (previous year: € 506.6 million). Adjusted for positive currency effects, the operating sales decline amounted to 4 %. This development is due both to lower sales volumes compared to the previous year and to a changed product mix. The main driver for the drop in sales of electrical insulation products was again the generally weaker economic situation. This development was reflected in 2019 in all of ELANTAS’ major business areas.

Regional sales dynamics were uneven. ELANTAS achieved sales growth in the Americas region. Adjusted for positive exchange-rate effects, sales were at the previous year’s level. In Europe and Asia, on the other hand, the division recorded declining sales in all major markets, which were particularly affected by weak demand in China, ELANTAS’ most important single market, as well as in Germany and Italy.

Sales Performance of ACTEGA

With sales of € 357.7 million (previous year: € 352.6 million), the ACTEGA division was the only ALTANA Group division to post nominal growth of 1 % compared to 2018. This increase was favored by positive exchange-rate effects. Adjusted for this effect, operating sales were slightly above the previous year’s level. A minor decline in sales volumes was offset by positive effects from a changed product mix and a somewhat higher price level.

ACTEGA’s business developed positively in the main application fields. For example, activities with functional products for food packaging were increased compared to the previous year, in some cases significantly. On the other hand, ACTEGA recorded lower sales in the flexible packaging business as well as in magazines and printed inserts.

The regional sales structure of the ACTEGA division did not change significantly in 2019. With the exception of the U.S. sales market, the overall trend in the division’s core regions was positive. In Europe, the largest region, net sales were slightly above the previous year’s level. Operating growth, particularly in Germany, more than compensated for a decline in other European countries. In the Americas, nominal sales increased compared to the previous year. Adjusted for the positive exchange-rate effects resulting from the development of the U.S. dollar, operating sales were below the level of 2018. In the U.S., the division’s largest single market, operating sales fell sharply in year-to-year terms, while in Brazil they increased strongly. In Asia, too, the division was the only one to further increase its sales level in 2019.

Earnings Situation

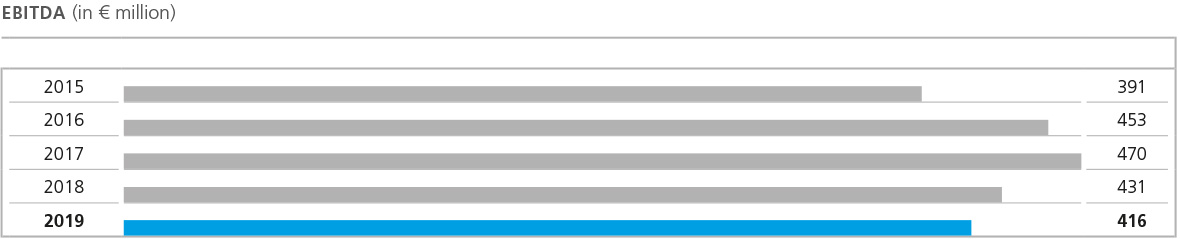

The operating sales decline was reflected by the earnings situation. Earnings before interest, taxes, depreciation and amortization (EBITDA) fell by 3 % or € 14.8 million to € 415.8 million (previous year: € 430.6 million). Since negative acquisition and currency effects had only a minor impact on earnings, the operating sales decrease adjusted for these effects also amounted to 3 %. The EBITDA margin in the 2019 fiscal year, however, at 18.5 % (previous year: 18.7 %), is once again within our strategic target range of 18 % to 20 %. This was achieved through extensive cost containment measures, which were already initiated in the fourth quarter of 2018 in view of the emerging slowdown in demand.

The development of absolute EBITDA was below our expectations, as the decline in demand, particularly from the automotive sector, as well as the general economic slowdown, was more severe than initially assumed. On the other hand, the EBITDA margin was almost at the previous year’s level due to the cost measures implemented and is therefore in line with our forecast for last year.

The most important cost factor for ALTANA, variable rawmaterial and packaging costs, developed positively in relative terms. The material usage ratio, the ratio of these costs to sales, fell to 42.7 % in 2019 (previous year: 43.8 %). All four divisions benefited from this trend, albeit to varying degrees.

Among the other main cost items, particularly personnel expenses and depreciation and amortization increased. Personnel expenses rose by 6 %. The main drivers were the general increase in collective bargaining costs, exchangerate effects, and hiring in the previous year. The ratio of total personnel expenses to sales increased to 22.7 % (previous year: 20.9 %) due to the decline in sales. Depreciation and amortization increased as a result of the high level of investment in property, plant and equipment and the first-time adaption of depreciation on rights of use under leasing agreements. The disproportionate increase in both depreciation and amortization and personnel expenses affected all functional cost areas.

In general, the structure of the functional costs in 2019 changed only insignificantly compared to 2018. Within production costs, personnel expenses and depreciation and amortization in particular rose disproportionately due to the strategic expansion of our sites and the expansion of production capacity. In contrast, other major kinds of costs in the production area remained stable or declined.

In 2019, selling and distribution expenses were slightly lower than in the previous year, but the relative ratio to sales increased slightly due to the sales drop. The decline in selling and distribution expenses was driven in particular by lower sales commissions and lower travel and trade fair costs, whereas personnel expenses and depreciation and amortization rose.

Of all the functional cost areas, research and development expenses exhibited the strongest growth in 2019, as in the previous year. On account of the continuous expansion of development activities in nearly all of our four divisions and the expansion of strategic activities to build future fields of business, the ratio of research and development costs to sales increased from 6.7 % to 7.4 %. This trend was additionally driven by initiatives in application-oriented research and stepped-up activities to develop new technologies that can be used to market innovative products. In order to successfully implement these goals, we intensified our investments in personnel and laboratories in 2019, which led in particular to increased personnel expenses and depreciation and amortization within the functional area of research and development.

Administrative expenses in 2019 were lower than in 2018, and the ratio of administrative expenses to sales remained stable at the previous year’s level.

The balance of other operating income and expenses was down on the previous year. This development is almost exclusively due to one-time special expenses in 2019 resulting from the harmonization of the organoclay product group in the BYK division. Earnings before interest and taxes (EBIT) reached € 262.5 million, 10 % below the previous year’s figure (€ 295.8 million) in operating terms.

At € 7.9 million, the financial result was significantly better than in 2018 (€ - 7.2 million). The background for the improvement was in particular interest income received from tax mutual agreement procedures as well as changes in the value of investments and an outstanding earn-out obligation from an acquisition. On the other hand, the result of companies accounted for using the at-equity method worsened, from € - 24.5 million in the previous year to € - 39.1 million in the 2019 fiscal year. This was due to the higher annual losses of the Israeli Landa Corporation Ltd. as a result of the planned higher expenditure for future digital-printing solutions in 2019 in the course of the market launch that had already begun. This was compounded by the first-time recognition of depreciation and amortization of the development expenses identified at the time of acquisition.

Earnings before taxes (EBT) fell to € 231.3 million (previous year: € 264.1 million), and earnings after taxes (EAT) to € 169.0 million (previous year: € 187.0 million). As a consequence, income tax was below the previous year’s level due to the earnings decline. In addition, the income tax burden was positively influenced by tax income received from tax mutual agreement procedures.

Capital Expenditure

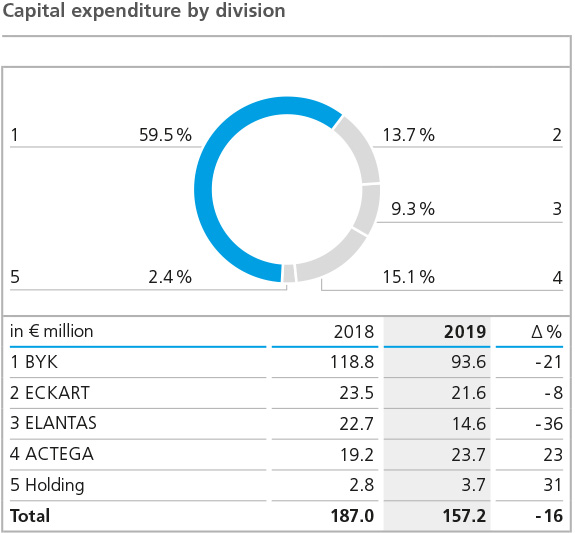

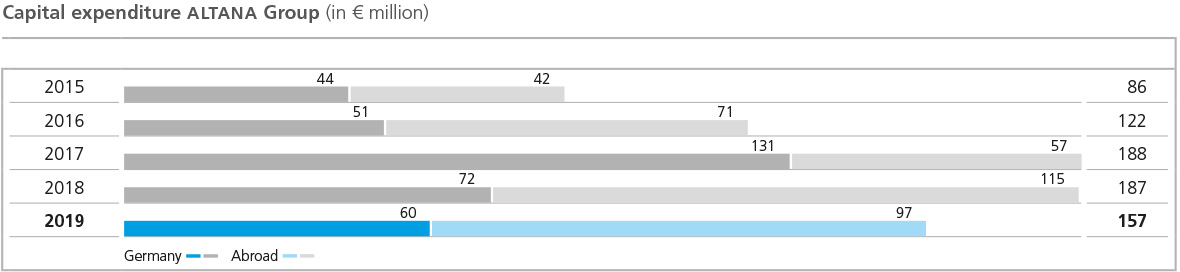

In the past fiscal year, ALTANA invested a total of € 157.2 million in intangible assets and property, plant and equipment (excluding the addition of rights of use from leasing agreements). As a consequence, capital expenditure was significantly below the high level of the previous year (€ 187.0 million). At 7.0 %, the investment ratio, that is the ratio of investments to sales, was above our long-term target range of 5 % to 6 % due to numerous strategic growth projects.

Overall, € 146.9 million was invested in property, plant and equipment (previous year: € 171.8 million). For several years, major projects have been carried out for the strategic expansion of production and laboratory capacities. Investments in intangible assets reached € 10.3 million in the past fiscal year, compared to € 15.2 million in 2018.

The regional distribution of investments did not change significantly in the past fiscal year. The European share was almost unchanged from 2018 at 49 % (previous year: 51%), with the largest share in Europe attributable to German sites, as in previous years. By contrast, the Americas recorded an increase of 40 % in the 2019 fiscal year (previous year: 31 %), while Asia’s share decreased to 11 % (previous year: 18 %).

In 2019, the BYK division invested a total of € 93.6 million, less than in the previous year (€ 118.8 million). As in 2018, the investment activity focused on the expansion of manufacturing capacities for rheology additives in the U.S. and on a site in China. In addition to research and development capacities at various locations, other investments related to a facility for carrying out automated product tests on additives at the Wesel site and strategic digitalization projects.

At € 21.6 million (previous year: € 23.5 million), the investment volume in the ECKART division was slightly lower than in the previous year. By far the most significant share was split equally between the division’s largest site in Güntersthal and a site in the United States.

The ELANTAS division invested a significantly lower amount in property, plant, and equipment and intangible assets than in the previous year (€ 14.6 million compared to € 22.7 million in 2018). In the past fiscal year, the division invested primarily at its sites in Italy and the U.S.

Investing € 23.7 million, the ACTEGA division’s capital expenditure was at a higher level than in 2018 (€ 19.2 million). Investments in the past fiscal year mainly related to the expansion of manufacturing capacities and the construction of a new innovation center at one of the division’s German sites. More was also invested at the division’s U.S. and Brazilian sites than in previous years.

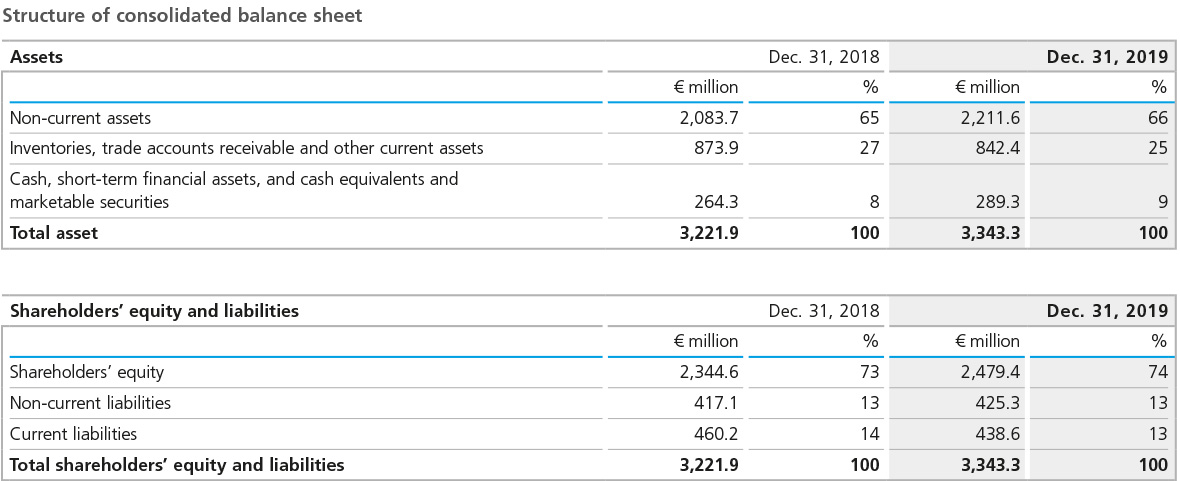

Balance Sheet Structure

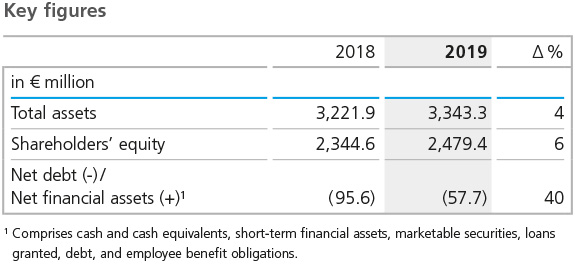

In the course of the 2019 fiscal year, the ALTANA Group’s total assets climbed from € 3,221.9 million to € 3,343.3 million. The increase of € 121.4 million, or 4 %, is mainly due to continued high investment activity, the first-time adaption of rights of use under lease agreements, as well as exchange-rate effects. Particularly the change of the euro in relation to the U.S. dollar led to an increase in the carrying amounts of assets and debts of the U.S. Group companies in the consolidated financial statements.

Intangible assets fell slightly to € 1,023.9 million (previous year: € 1,044.2 million). There were no business combinations or technology acquisitions with a significant impact on intangible assets in the past fiscal year. In contrast, there was a significant increase in property, plant and equipment, which rose further from € 868.2 million to € 970.8 million. With additions of € 146.9 million, the level of investment in property, plant and equipment was significantly higher than depreciation and amortization (without taking into account the addition of right-of-use assets from leasing agreements). Exchange-rate effects also led to an increase in carrying amounts in the Group currency, the euro. On December 31, 2019, non-current assets totaled € 2,211.6 million (previous year: € 2,083.7 million), € 127.9 million up on the previous year. Their share in total assets increased slightly to 66 % (previous year: 65 %).

The change in current assets was influenced particularly by the decrease in net working capital. Both inventories and trade accounts receivable fell in the past fiscal year as a result of the decline in demand and the implementation of specific measures. The 6 % decrease in inventories to € 348.8 million was due to a reduction in stocks of finished products and a lower level of raw materials. The change in inventories also had a significant impact on the development of total net working capital. The balance of inventories, trade accounts receivable, and trade accounts payable fell by € 14.8 million to € 547.0 million. The ratio of net working capital, in relation to the business development of the previous three months, slightly decreased to 108 days, after 109 days at the end of 2018, meaning that both the absolute net working capital and the ratio developed in line with our expectations. At the beginning of the year, we had forecast a change in absolute net working capital in keeping with the general business trend and a slight improvement in scope. Cash and cash equivalents increased in the course of the year to € 264.6 million (previous year: € 239.7 million). Total current assets fell slightly to € 1,131.7 million (previous year: € 1,138.1 million).

On the liabilities side, changes arose primarily due to the earnings-related increase in equity. Group equity rose by € 134.8 million, or 6 %, to € 2,479.4 million (previous year: € 2,344.6 million). The increase is attributable to the surplus in the 2019 financial year and, to a lesser extent, to positive effects of exchange-rate fluctuations. The revaluation of net pension obligations had a counteracting effect. The equity ratio rose to 74 % on December 31, 2019 (previous year: 73 %).

The Group continued to report liabilities from promissory note loans as an essential component of the debt at the end of 2019. These liabilities were reduced further in the past fiscal year by scheduled repayment of a tranche (€ 80.0 million) and amounted to € 48.0 million at the end of the year, which is reported under current debt. Further significant liabilities as of the balance sheet date related to the liabilities from leasing obligations reported for the first time amounting to € 42.9 million.

The total non-current liabilities were affected on the one hand by the increase in pension provisions due to the further decline in the discount rate used to discount the corresponding obligations. On the other hand, the deferred taxes reported on the liabilities side of the balance sheet decreased. In total, non-current liabilities increased by € 8.3 million to € 425.3 million (previous year: € 417.0 million).

The total current liabilities reported in the balance sheet as of December 31, 2019, decreased from € 460.2 million to € 438.6 million. This was partly due to the lower current financial liabilities from promissory note loans, which were only partially offset by the first-time recognition of liabilities from lease obligations. On the other hand, trade payables also declined.

The net financial debt, comprising the balance of cash and cash equivalents, short-term financial assets, current marketable securities, loans granted, debt, and employee benefit obligations, was reduced to € 57.7 million at the end of 2019, after net debt of € 95.6 million in the previous year.

Principles and Goals of Our Financing Strategy

We generally aim to finance our operating business activities from the cash flow from operating activities. The same applies to the need for capital expenditure, which caters to the continual expansion of business activities.

As a result, our financing strategy is oriented to keeping the cash and cash equivalents generated within the Group centralized. In addition, a financing framework is sought that enables ALTANA to flexibly and quickly carry out acquisitions and even large investment projects beyond the accustomed scope.

To successfully implement these goals, we manage nearly all of the Group’s internal financing centrally via ALTANA AG. To this end, cash pools are set up for the important currency areas.

At the end of 2019, ALTANA’s liabilities still totaled € 48.0 million due to the issuance of promissory note loans. The loans will be repaid by 2020. Furthermore, there is a general syndicated credit facility of € 250.0 million. The term of this credit facility will last until 2022 and had not been utilized on the balance sheet date.

This financing structure offers ALTANA the flexibility it needs to appropriately take advantage of short-term or investment-intensive growth opportunities. The distribution of the maturities of the financing instruments we use enables us to optimally control repayment of liabilities with inflows from operating cash flow.

Off-balance-sheet financing instruments result from purchasing commitments and guarantees for pension plans. Details on the existing financing instruments are provided in the online Consolidated Financial Statements.

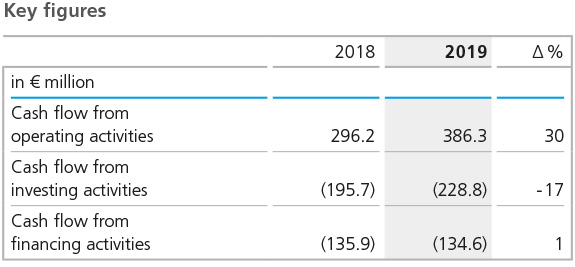

In the course of 2019, cash and cash equivalents increased by € 24.9 million to € 264.6 million (previous year: € 239.7 million). At € 386.3 million, cash inflow from operating activities was significantly higher than in the previous year (€ 296.2 million), despite the lower Group net income. This is primarily due to the fact that the funds tied up in net working capital were reduced in the course of the year, whereas in the previous year the balance of inventories, trade accounts receivable, and trade accounts payable was still increasing. The change in inventories was the main driver of this development. In addition, a higher proportion of net income in the past year was attributable to noncash expenses.

Cash flow from investment activities rose to € 228.8 million (previous year: € 195.7 million). Although investments in intangible assets and property, plant and equipment were at a lower level than in the previous year, the repayment of a loan of € 71.0 million was made in the previous year and expenditure on acquisitions in 2019 was higher than in the previous year.

In the 2019 fiscal year, cash flow from financing activities amounted to € 134.6 million and was thus at the previous year’s level (€ 135.9 million). The current debt outflows concerned the scheduled repayment of a promissory note tranche totaling € 80.0 million and lease payments. In the 2019 fiscal year, ALTANA AG paid a dividend amounting to € 50.0 million (previous year: € 80.0 million).

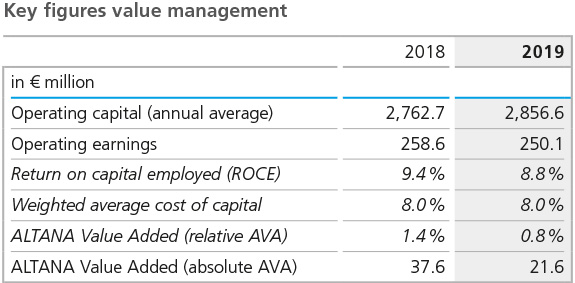

ALTANA determines the change in the company’s value via the key figure ALTANA Value Added (AVA), whose calculation is explained in the “Group Basics” section. In 2019, a positive contribution was made to our company’s value again, which, however, was lower than in 2018 and was below our expectations.

The sales-related decline in earnings is reflected in lower operating earnings, which at € 250.1 million did not quite reach the previous year’s level (€ 258.6 million) and was boosted by a positive non-recurrent effect resulting from the tax rate used in the calculation. At the same time, the Group’s average capital employed rose to € 2,856.6 million in 2019 (previous year: € 2,762.7 million). This increase in capital largely resulted from the high level of investment in property, plant and equipment over the past two years. Changes in exchange rates also contributed to the higher capital level. With an unchanged cost of capital rate of 8.0 %, the cost of capital rose to € 228.5 million (previous year: € 221.0 million).

The return on capital employed (ROCE) amounted to 8.8 % in 2019 and thus did not reach the previous year’s level (9.4 %). Absolute value added amounted to € 21.6 million in the past fiscal year, compared to € 37.6 million in the previous year, and relative AVA fell from 1.4 % to 0.8 % in 2019.

The slight improvement in value management key figures forecast for 2019 could not be achieved due to the weaker earnings performance.

Overall Assessment of Our Business Performance and Business SituationIn the course of 2019, the macroeconomic framework deteriorated increasingly, leading to a decline in demand, particularly in the automotive industry and in the important sales market China. As a result, we were not able to achieve our sales and earnings targets in 2019. However, the effects of the sales decrease on the earnings situation were largely offset by the early introduction of comprehensive countermeasures on the cost side, so that profitability was within our strategic target range. At the same time, we continued to press ahead with our strategic activities to develop medium- to long-term growth areas and with the digital transformation. Our balance sheet continued to show a very solid structure at the end of 2019 and offers sufficient financial headroom for investments in sustainable profitable growth. |