Letter from the Management Board | About This Report | Sustainability Management | Corporate Bodies and Management | Report of the Supervisory Board | ALTANA in Everyday Life | Group Management Report | Products | Safety and Health | Environment | Human Resources | Social Commitment | Consolidated Financial Statements (condensed version) | Multi-Year Overview | Global Compact: Communication on Progress (COP) | ALTANA worldwide | List of Full Ownership | Overview - About This Report | Contact

Organization and Legal Structure

The ALTANA Group is a global supplier of specialized chemical products and related services for different branches of industry and application fields. In the 2020 fiscal year, the Group’s 68 consolidated subsidiaries and associated companies achieved sales of more than € 2.2 billion. The ALTANA Group employs about 6,500 people.

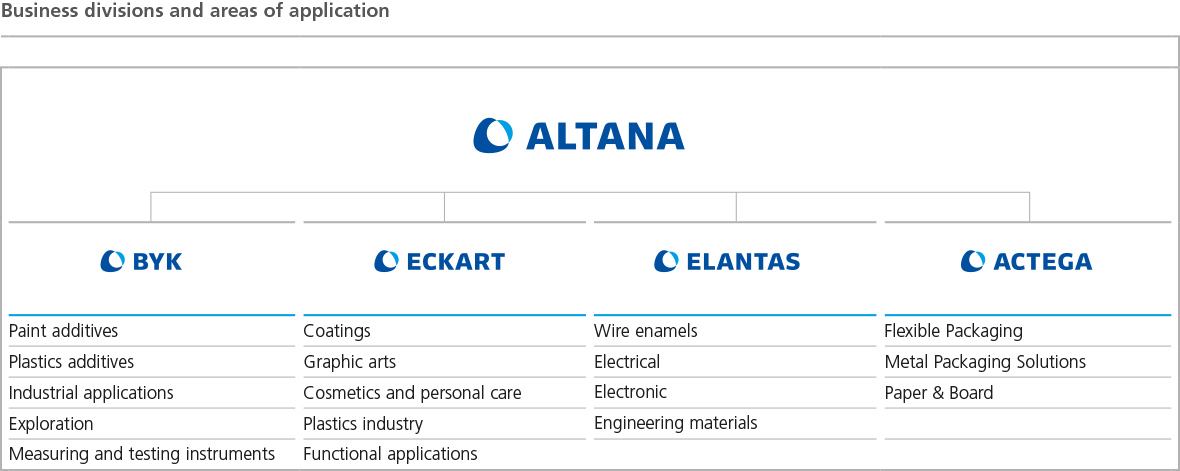

ALTANA’s activities are grouped into four divisions, each of which has its own management and organizational structure. The divisions and the Group companies assigned to them are decentralized and empowered to largely make market-, location-, and product-related decisions themselves. The divisions are active worldwide and have their own production sites and sales offices as well as research and development laboratories in the regional markets that are important for them. In addition to the four operating divisions, there are holding companies in which Group management activities and internal services are bundled. Furthermore, activities for the cross-divisional development of new business areas are undertaken at this level.

ALTANA AG, headquartered in Wesel, is a stock corporation in accordance with German law. As the ALTANA Group’s managing company, it assumes strategic control of the Group and the divisions. ALTANA AG is led by the Management Board, whose members act on their own responsibility and are solely committed to the interests of the company. The Management Board’s activities are monitored by the Supervisory Board, whose members also advise the Management Board. More information on ALTANA AG’s management and control system is provided in the Declaration on Corporate Governance in the Group Management Report.

All of the shares in ALTANA AG are held by SKion GmbH, Bad Homburg v. d. H., Germany, an investment company owned by Susanne Klatten.

The decentralized organizational structure combines the individual operating units’ ability to act swiftly and cater to the needs of markets and customers with the advantages of a financially strong and internationally active group. The organization is designed to adapt flexibly to changed market conditions and a volatile economic environment. In addition, new activities can be integrated into the organization in a short time.

Business Activity and Divisions

As a globally active specialty chemicals group, ALTANA focuses its core activities on sophisticated markets and customers who need individual solutions.

A significant share of the ALTANA Group’s product and service portfolio encompasses input materials for the production of coatings, printing inks, and plastics. In addition, ALTANA manufactures printing inks and coatings for special applications, products for 3D printing, insulating resins for the electrical and electronics industries, sealants for packaging, and measuring and testing instruments.

Activities of the Divisions

BYK

The BYK division is one of the leading international suppliers of special-purpose ingredients, so-called additives, used in coatings and paints, plastics, exploration, and other industrial applications. The division’s products, most of which are used in only very small amounts, have a decisive influence on the properties of their customers’ end products or enable customers to improve their manufacturing and industrial processes.

Wetting and dispersing additives, one of the division’s main product groups, help improve the even distribution of pigments and filling materials, and enable them to function better, for example in coatings and plastics. With the help of defoamers and air-release additives, foaming is prevented during the manufacture of coatings and paints as well as in end customers’ applications. Surface additives are used to produce special properties such as shiny, matte or especially smooth surfaces. Rheology additives improve, for example, the flow behavior of coatings and plastics. The division also manufactures measuring and testing instruments that are used to determine surface properties, color shades, and optical effects.

BYK-Chemie GmbH, based in Wesel, is the management company of the division. In addition, it is the division’s biggest production and development site for additives and the ALTANA Group company with the highest sales. BYK also produces at other sites in Germany, the Netherlands, Great Britain, as well as in China and the U.S. All of the measuring and testing instruments are manufactured at a site in southern Germany (Geretsried).

The division sells its products primarily under the brands BYK (additives) and BYK-Gardner (instruments). Due to its comprehensive portfolio, BYK is a system supplier and partner of coatings manufacturers and plastics processors in particular. On the basis of its great problem-solving expertise, BYK has also attained an important market position in many other industrial application fields in recent years.

The division markets its products in the important regions via its own companies and branches. In addition, a dense network of dealers and agents markets its products worldwide. BYK generates the highest share of its sales in Europe, followed by Asia and the Americas. In terms of countries, the U.S. makes the largest contribution to sales, followed by China and Germany.

BYK continually expands and supplements its product portfolio. To gear its innovation activities closely to the needs of the markets, the division has its own network of development laboratories, which cooperate closely with customers in the respective regions. At the same time, new fields of application are continually tapped for existing or new products.

ECKART

ALTANA concentrates the development, production, and sale of effect pigments in the ECKART division. Customers use these products to achieve visual and functional effects, primarily in coatings, plastics, printing inks, cosmetics, and construction materials. The principal raw materials are aluminum, copper, and zinc. Aside from metallic effect pigments, other pigments are offered based on artificial substrates. The division’s portfolio is supplemented by effect printing inks, metal powders and alloys for 3D printing, and services.

Aluminum-based effect pigments comprise the largest part of ECKART’s business. Customers use them particularly to achieve silver metallic effects, for example, for car paints or on graphic arts products. Aluminum pigments are also used for functional purposes, for example, in the manufacture of aerated concrete. Bronze effect pigments generate golden effects in paints, printing inks, and plastic products. Customers use zinc pigments in special paints to achieve functional properties, particularly for corrosion protection.

ECKART GmbH is the division’s operating management company. It produces a large part of the effect pigments it sells worldwide in southern Germany (Hartenstein and Wackersdorf). Other manufacturing sites are located in Switzerland and Finland, as well as in China and the U.S.

The manufacturing process is characterized by a very high degree of value creation. In a number of successive steps, all kinds of pigments are made, refined chemically, and in some cases processed into press-ready printing inks.

The effect pigments are marketed predominantly via the division’s own sales structures, but also by sales partners. ECKART’s most important customers include international manufacturers of coatings, printing inks, and plastics.

Other important customers are manufacturers in the construction industry and the cosmetics sector. ECKART achieves nearly half of its sales in Europe. Its next largest sales regions are Asia and the Americas.

As an important manufacturer of metal effect pigments, ECKART continually pushes forward the development of new product qualities and opens up new fields of application on the basis of sophisticated technological expertise and many years of knowhow. The acquisition of the British specialist Aluminium Materials Technologies Ltd. (May 2020) and the business activities of TLS Technik GmbH & Co. Spezialpulver KG in February 2021 will expand the portfolio in industrial, metal-based 3D printing and in the future customers can be offered even more high-performance materials.

ELANTAS

The companies in the ELANTAS division offer their customers a high level of expertise in the field of electrical insulation materials. As one of the world’s leading suppliers of such products, the division’s portfolio concentrates on coatings for insulating magnet wires as well as special resins and coatings for impregnating and protecting electrical and electronic components.

ELANTAS has its own holding structure under the management of ELANTAS GmbH, based in Wesel. The latter controls the division’s activities and supports its operating subsidiaries, which develop and produce insulating materials in Germany, Italy, China, India, Malaysia, the U.S., and Brazil.

The division’s products are marketed worldwide. Among its most important customer groups are magnet wire manufacturers, which need materials to insulate wires made of copper or aluminum. The division also supplies insulating resins and coatings directly to manufacturers of electrical and electronic components.

ELANTAS’ most important sales region by far is Asia, and particularly China. A high proportion of global manufacture of electrical and electronic components and consumer goods is concentrated in this region. The division has had its own production sites in China, India, and Malaysia for years. After China, its most important sales markets are the U.S., India, and Italy.

On the basis of comprehensive expertise in the manufacture and application of liquid insulating systems, the division is steadily expanding its activities. It seeks to tap new application fields and thus growth potential by developing new insulating materials and applying specific polymerization knowhow. The global trend towards electromobility should ensure additional growth in this area.

ACTEGA

The ACTEGA division’s portfolio is tailored to the needs of the packaging and graphic arts industries. It produces specialty coatings, printing inks, adhesives, and sealants used by customers to achieve functional and visual effects.

ACTEGA is managed by the holding company ACTEGA GmbH, based in Wesel. Its business activities are divided into three business lines: Flexible Packaging, Metal Packaging Solutions, and Paper & Board. In the area of research and development, activities are bundled in four technology groups. The products are distributed and manufactured by subsidiaries in Germany, Switzerland, France, Spain, China, the U.S., Brazil, Canada, and Chile.

Important product groups of the division include waterbased coatings and printing inks, as well as sealants and adhesives used to make packaging materials. A focal point of its product portfolio is the specific needs of the food industry with its high quality requirements. In addition, there is a demand for ACTEGA’s printing inks and overprint varnishes among customers in the graphic arts industry. The division’s largest sales region is Europe, followed by the Americas. Its most important individual markets are Germany and the U.S.

Together with the packaging industry, and in direct contact with brand manufacturers, ACTEGA develops new and improved optic and haptic functionalities. Its innovation activities primarily aim to improve the safety and shelf life of packaged foods.

In recent years, the division has invested in a targeted way in the acquisition and further development of new technologies in order to tap new growth potential in the medium to long term for its existing business, to prepare its entry into new markets, and to make additional progress in the area of packaging sustainability. For example, the startup ACTEGA Metal Print was able to win its first beta customers and a distribution partner for a novel technology that achieves decorative metallic effects with significantly less material, costs, and production time than the processes commonly used to date.

Important Influences on Business Development

ALTANA’s different sales markets are influenced by various short-, medium-, and long-term trends.

Short- and medium-term fluctuations in demand result mainly from economic developments. The current development of consumer behavior is not the only factor. Our customers’ expectations regarding the short-term development of the end markets downstream in the value chain also have a significant impact on their purchase behavior. This appraisal largely determines how much storage is reserved along the value chain.

In addition, actual and expected changes in the prices of essential raw materials impact the sales situation. When raw-materials prices continually rise, customers look for alternative input materials and this influences overall sales or the product mix. The same applies to significant changes in other cost components that have a strong influence on the price of products. This price sensitivity of the markets is also reflected in short-term changes in demand, when for example stronger price fluctuations are expected for significant raw-materials markets.

The competitive situation in the different product-specific market segments can have similar effects on customer behavior. The entry of new manufacturers into a market or the withdrawal of existing manufacturers from a market and the competitors’ prices can impact demand.

Long-term changes in demand for the Group’s products and services are brought about on the one hand by global megatrends and the economic growth of certain regions. On the other hand, product and technological developments continually open up new sales potential or lead to product segments being discontinued.

In the course of a year, seasonal fluctuations in demand result from lower customer activity, especially during the Chinese New Year Festival, during the summer months, and at the end of the year.

Strategy and Control System

Strategy

Current market requirements, and market demands expected for the future, determine the ALTANA Group’s corporate action. The success of our customers is at the center of our business activities. We can only be successful in the competitive environment in the long run if we offer our customers added value.

Our top financial priority is to sustainably increase the company’s value. To achieve this aim, we consistently gear ALTANA to profitable growth in future-oriented specialty chemicals markets.

At ALTANA, profitable growth is based on several pillars. The primary ones are to expand our operating activities in existing markets and to open up new adjacent sales segments. ALTANA’s four divisions occupy significant competitive positions in their respective sales markets. This positioning is an important prerequisite for our being identified and acknowledged by market participants as a competent supplier of customized solutions. In addition to ALTANA’s comprehensive product portfolio, innovation plays a key role in its high level of problem-solving expertise.

To enable customers to create new applications and strengthen their portfolio, ALTANA continually pushes forward its own research and development activities. To this end, our employees’ knowhow and experience are just as important as investments in new technologies.

To continually expand our specialized portfolio, we regularly supplement our operating growth by acquiring new companies or business activities. As a result, for example, new value creation steps are integrated into the Group or access to new markets and technologies is granted.

Control System and Goals

ALTANA’s control system is fundamentally oriented to the goal of a sustainable increase in the company’s value. A number of ratios, mainly financial, are derived whose developments are analyzed and for which target values are determined. The most important key performance indicators are ALTANA Value Added (AVA), sales growth, earnings before interest, taxes, depreciation and amortization (EBITDA), as well as the EBITDA margin and the investment level in relation to sales.

A change in the company’s value in a given period is calculated by using the financial ratio ALTANA Value Added. The absolute AVA is calculated by subtracting the cost of capital employed in the Group from the operating earnings. The relative AVA constitutes this difference in proportion to the capital employed. It is calculated by subtracting the cost of capital from the return on capital employed (ROCE).

The calculation of the operating earnings starts with earnings before interest and taxes (EBIT), which are adjusted for acquisition-related and one-time special effects and from which a calculated tax burden is deducted.

The capital employed, in turn, encompasses those components of the assets and liabilities needed to achieve operating earnings. The cost of capital is determined from the weighted average of cost of debt and cost of equity. We regularly examine the weighted average cost of capital but only adjust it for the calculation of the AVA if it exceeds or falls below a certain range. For 2020, we reduced the cost of capital from 8.0 % to 7.5 %. This cost of capital rate will continue to be used in 2021.

Key performance indicators are used for measuring the company’s success and as criteria for strategic and operational decisions at the level of the Group holding company, the divisions, and individual companies. In addition, the key figure AVA is also used to determine variable compensation components.

Our goal is to achieve operating earnings that exceed the cost of capital on a sustainable basis. In recent years, we have managed to generate a positive AVA.

Sustainable profitable sales growth forms the basis for a long-term increase in our operating earnings and thus in the value of the company. ALTANA’s goal is to outperform the general market growth in the most important sales segments and thus to obtain market shares.

In the long term, we aim to achieve average annual operating sales growth of 5 %. We seek to generate additional growth through acquisitions, either by acquiring supplementary activities at the level of our existing divisions or through the possible integration of new business activities.

But growth should not be achieved at the expense of profitability. Therefore, control of the EBITDA margin is very important for the ALTANA Group. The long-term target range for the EBITDA margin of the Group is 18 % to 20 %. Derived from this are long-term target margins for our four divisions, which may deviate from the average target value for the Group due to the different business activities and market characteristics. In the last years, the Group margins achieved were within or, in some years, even above the target range.

In addition to pursuing long-term sales and earnings growth, another focus to successfully increase the value of the company is control of the operating capital. The main factors of influence in this context are the development of fixed assets and of net working capital.

On average over several years, our investments in property, plant and equipment and intangible assets have been around 5 % to 6 % of our sales. Due to this continuity, sharp increases in operating capital and resulting short-term fluctuations of the AVA can be minimized. In addition, every important investment is examined regarding its short- and long-term effects on the company’s value.

For the control of net working capital, which is of great importance for the development of operating capital, we use key performance indicators to analyze and control profitable growth and the company’s value. These key performance indicators concern the scope of inventories as well as trade accounts receivable and payable.

Apart from the aforementioned essential financial control parameters, there are other financial key indicators that help us analyze and control profitable growth and the company’s value. The most important ones are cost figures (cost of materials, personnel expenses, etc.).

To guarantee that all activities are geared uniformly to the Group’s strategy, we also use non-financial key performance indicators. Significant control-relevant non-financial indicators and thus key performance indicators for Group management relate to the areas of occupational safety and climate neutrality. To track the achievement of the goal of continuously improving occupational safety, the Work Accident Indicator (WAI) is used, which includes WAI 1, WAI 2, and WAI 3, as a key performance indicator. The WAI shows the number of reported occupational accidents with lost work days in relation to one million hours worked in the respective attribute defined per key performance indicator. Furthermore, the ALTANA Group is pursuing the goal of achieving climate neutrality in its sphere of influence by 2025. For the quantitative measurement of this strategic goal, there is a reporting system for CO2 emissions. The latter are reported as direct greenhouse gas emissions from sources controlled by the company (Scope 1) and as indirect greenhouse gas emissions from the performance-related purchase of electricity (Scope 2).

Apart from these two groups of indicators, there are other non-financial indicators which are not regarded as being relevant for control. These include data for the evaluation of innovation activities as well as other key performance indicators in the area of sustainability, for the analysis of sales markets and customer satisfaction.

Integrated Planning Processes

All of the key performance indicators relevant for control are compiled and analyzed within the framework of standardized reporting processes. To be able to use these key parameters effectively to control our strategy and possible short- and medium-term measures, there is an integrated planning process embracing different planning levels and dimensions.

The planning cycle has a strategic planning component, which combines the analysis of the essential performance indicators for future business development at the product group level with a detailed representation of the changes expected in the market environment.

From this, strategic measures are derived enabling us to react to expected developments at an early stage. These measures, developed in the strategic planning process, include not only fields of activity on current sales markets, but also concrete goals and planning steps for entry into new fields of business or application areas and changes in the portfolio of business activities.

The decisions taken within the framework of strategic planning enter into our subsequent medium-term financial planning. The latter delineates our growth and profitability goals for the coming three years and the effects of the expected business development on ALTANA’s asset and financing structure. This is used to derive possible measures for our financing strategy. Our medium-term financial planning is supplemented by scenario analyses, which transparently reflect the sensitivities of the key performance indicators to relevant, predominantly cyclical changes in the market environment. From this, we derive levels of reaction for possible countermeasures.