Corporate Report 2023: Letter from the Management Board | About This Report | Sustainability Management | Corporate Bodies and Management | Report of the Supervisory Board | Now - for the Future | Group Management Report | Products | Safety and Health | Environment | People | Social Commitment | Consolidated Financial Statements (condensed version) | Multi-Year Overview | Global Compact: Communication on Progress (COP) | ALTANA worldwide | List of Shareholdings | Overview | Contact

General Business Setting

Overall Economic Situation

In 2023, the global economy was notably influenced by persistent and emerging geopolitical conflicts, contributing to an overall challenging economic environment. Russia’s war against Ukraine since February 2022 and renewed conflicts in the Middle East, aside from their devastating humanitarian repercussions, remained pivotal factors causing ongoing uncertainty regarding the availability and pricing of raw materials and the stability of global supply chains. Following 3.5 % global growth in the preceding year, the International Monetary Fund (IMF) currently projects a 3.1 % increase in global economic output for 2023. This indicates that, similar to the previous year, the achieved growth rate remains below average. For the second consecutive year, economic activity in numerous countries was characterized by diminishing yet still historically high inflation rates. Elevated cost levels and countermeasures implemented through monetary policies subdued markets across various sectors.

China’s economic development in 2023 exhibited deflationary tendencies, and the ongoing crisis in the real estate sector further weakened the country’s growth for the year.

The IMF projects that growth in the Eurozone remained weak in 2023. Following a 3.4 % growth rate in the previous year, economic output is projected to have contracted to 0.5 %. The economic region faced significant challenges, particularly stemming from the consequences of high inflation and the subsequent decline in demand. This impact was felt across all major markets, albeit to varying degrees. The IMF estimates indicate that Germany, in particular, witnessed a slight contraction of 0.3 % in economic output, compared to a growth rate of 1.8 % in the preceding year. This decline can be attributed mainly to the substantial reliance on Russian gas and the uncertainty surrounding energy supplies due to Russia’s ongoing war against Ukraine. The IMF also notes that growth rates in other Eurozone markets experienced a downturn but remained positive. For instance, Italy saw a growth of 0.7 %, France at 0.8 %, and Spain at 2.4 %.

Based on the latest IMF estimates, the overall economic development in the Americas showed modest positive growth in 2023, against a backdrop of decreasing inflation. The U.S. is reported to have achieved 2.5 % growth in gross value added, while Canada grew by 1.1 %. In the Latin American countries, growth reached 2.5 %, indicating a slight weakening compared to the previous year. This decline is primarily attributed to a significant contraction in Argentina, as projected by the IMF, plummeting from a 5.0 % growth in the previous year to - 1.1 %. Meanwhile, Brazil is estimated to have achieved growth of 3.1 %, maintaining a similar trajectory as in the preceding year, according to IMF estimates.

According to the IMF, there is an overall increase in gross domestic product projected for Asia in 2023. China, which recorded 3.0 % growth in the previous year, experienced a slight resurgence with a forecasted growth of 5.2 % in 2023. However, it fell short of matching the growth of previous years. India, with a growth of 7.2 % in the preceding year, largely sustained its momentum and achieved 6.7 % growth in gross value added, as estimated by the IMF. The countries comprising the ASEAN-5 group, after a 5.5 % increase in the previous year, achieved an overall growth rate of 4.2 %. Although Japan’s growth remained modest at 1.9 %, it marked an improvement over the previous year.

Industry Specific Framework Conditions

The American Chemistry Council (ACC) estimates that global chemical production grew by 0.3 % in the past fiscal year (previous year: 1.8 %). This indicates that the growth in the chemical industry remained below the overall economic growth rate for 2023. The cyclical downturn in demand for chemical industry products was observable across all markets, albeit to differing extents.

The German Chemical Industry Association (VCI) estimates that Germany, Europe’s largest chemical producer, experienced an industry-wide decline of 8 % in the past fiscal year. Excluding the pharmaceutical sector’s share, the VCI forecasts a steeper decline of 11 %. Additionally, the American Chemistry Council (ACC) reports that the chemical industry in Europe as a whole performed significantly below the global average, registering a decline of - 6.6 %.

According to the ACC, chemical production excluding pharmaceutical products in the USA also fell by 1.0 % overall and was therefore below the overall economic trend.

According to the ACC, production in North America as a whole even fell by 1.9 %. In Latin America, the industry was even weaker than in the north of the continent, with an overall decline of 3.6 %.

As per the ACC, the chemical industry in the Asia-Pacific region grew by 3.7 % in the 2023 fiscal year. As a result, it remained the only region to exhibit significant growth.

Following the turbulence on the energy markets in 2022 caused by Russia’s war against Ukraine, resulting in significant increases in the price of crude oil, the overall situation stabilized somewhat in 2023. Although the price of a barrel of Brent crude oil continued to exhibit strong fluctuations throughout the year, it did not reach the previous year’s peaks, peaking at 94 U.S. dollars in September 2023. By the end of the year, the price of a barrel of Brent gradually declined to 78 U.S. dollars. The average price for the year, at U.S. dollars, remained well below the previous year’s level of 99 U.S. dollars.

Important Events for Business Development

In 2023, non-operating effects impacted ALTANA’s earnings and financial position as well as its net assets.

Non-operating effects from acquisitions stemmed from two significant transactions in the 2023 fiscal year. On August 15, 2023, the BYK division acquired the business of Imaginant Inc., based in Rochester, New York, thereby enhancing its portfolio in ultrasonic measuring and testing instruments. Imaginant will be integrated into the instrument business of the BYK companies in the U.S. and Germany, resulting in a slightly positive effect on both sales and earnings. On September 29, 2023, the ELANTAS division completed the acquisition of the Swiss Von Roll Group, marking the second-largest acquisition in the history of the ALTANA Group. This move allowed ELANTAS to expand its portfolio, particularly in the high-voltage insulation sector. The acquisition positively impacted sales, but the earnings situation was slightly affected by acquisition and integration costs.

The fluctuation of ALTANA’s key exchange rates against the Group currency, the euro, predominantly exerted a negative impact on sales development in 2023 and, to a lesser extent, on earnings development. These adverse effects were slightly more pronounced than initially anticipated by ALTANA. The most significant impact in 2023 was attributed to the change in the exchange rate of the euro to the Chinese renminbi, averaging CNY 7.66 for one euro, which was higher than the previous year (CNY 7.08 for one euro). Further substantial negative effects arising from exchangerate changes were observed in the ratio of the U.S. dollar to the euro, standing at 1.08 U.S. dollars for one euro, lower than the previous year (1.05 U.S. dollars for one euro). A similar trend was noted in the Indian rupee, with a ratio of 89.30 INR to the euro (compared to the previous year’s 82.69 INR for one euro), and the Japanese yen, with a ratio of 151.99 JPY for one euro (compared to the previous year’s 138.03 JPY to the euro). In contrast, there were slightly positive effects in 2023 due to the depreciation of the Swiss franc and the Mexican peso against the euro. The average exchange rate of the euro to the Swiss franc decreased from 1.00 CHF for one euro to 0.97 CHF to the euro in 2023, and the average exchange rate of the euro to the Mexican peso decreased from 21.19 MXN for one euro to 19.18 MXN to the euro in 2023. In addition, differences in exchange rates as of the balance sheet date had a net negative impact on balance sheet items compared to the previous year.

Business Performance

Group Sales Performance

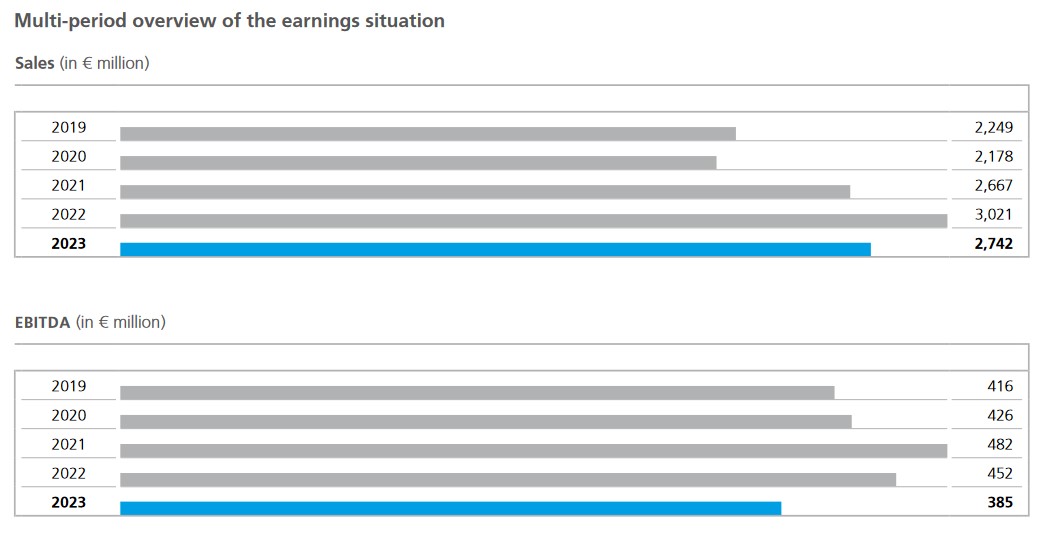

Due to challenging overall conditions, ALTANA was unable to replicate the sales performance of the previous year in 2023. Group sales amounted to 2,741.5 million €, reflecting a decline of 9 % or € 279.5 million compared to the previous year’s total of € 3,021.0 million. Non-operating effects had a slightly negative impact on the overall sales trajectory. The aforementioned changes in exchange rates led to a € 61.9 million decrease in foreign currency sales translation. On the positive side, the two acquisitions contributed to increased sales by a total of € 57.6 million. The acquisition of the Von Roll Group (€ 54.1 million) in September 2023, to be integrated into the ELANTAS division, played a major role. Additionally, the business activities of Imaginant Inc. in Rochester, New York, acquired for the BYK division in August 2023, contributed to additional sales growth of € 3.6 million. These effects were calculated based on the length of time of Group affiliation. The combination of negative exchange-rate effects and positive acquisition effects roughly offset each other, resulting in an operating sales trend of - 9 % compared to the previous year.

The persistent economic strain resulting from ongoing geopolitical crises has precipitated a pronounced decrease in demand for our products over six consecutive quarters. Despite initial hesitancy from our customers in reducing inventories amassed in prior periods to safeguard production, the anticipated uptick in demand for the second half of 2023 failed to materialize. Consequently, there was an overall decline in volumes by 8 %. Additionally, marginal declines in raw material and energy prices within specific product segments led to reductions in our sales prices, further contributing to the negative impact on sales development. Regrettably, the initially forecasted sales growth for 2023 in the mid single-digit percentage range could not be realized.

The decline in sales development was evident across all regions, although the intensity varied due to specific conditions in each sales region. Consequently, there were slight shifts in the regional sales structure. Europe, with a 38 % share of total Group sales (compared to 36 % in the previous year), remained the most important sales region for ALTANA. However, it experienced a sales decline of 4 %, or even 7 % when adjusted for acquisitions and exchange-rate effects. This decrease reflects the overall market slowdown, although Europe’s overall development fared slightly better than in other key sales regions for ALTANA. Germany, the market with the highest sales, encountered a disproportionately high loss compared to other markets in the Eurozone. Sales growth compared to the previous year was only achieved in some Eastern European markets.

Sales in the Americas in 2023 were down 11 % on the previous year, or 12 % adjusted for exchange-rate and acquisition effects. Sales in the U.S. fell by 12 % in operational terms. The share of total Group sales decreased to 19 % in 2023 (previous year: 20 %). However, as in the previous year, the U.S. remained the Group’s strongest market in terms of sales. Sales also fell in all other countries in the region, in some cases in the double-digit range. Canada lost 14 % in operational terms, followed by Mexico and Brazil. The Americas’ share of Group sales fell slightly to 29 % in 2023 (previous year: 30 %).

In the past fiscal year, Asia saw a further decline in its share of total Group sales, decreasing from 33 % to 31 %. Down by 13 %, the region marked the most substantial nominal drop in sales. Adjusted primarily for negative exchangerate effects, the operating sales decline amounted to 9 %. India and China, the key markets in the region, were the main contributors to this trend. While India emerged as the most dynamic market for ALTANA in 2023, experiencing 8 % operating growth, China witnessed a 10 % decline in operating sales. The region’s most significant individual market in terms of sales sustained a continued drop in demand, with its share of the Group’s total sales falling from 18 % to 17 %. The countries in the Middle East and the South East Asia region also reported a notable decline in sales figures.

Sales Performance of BYK

Sales in the BYK division fell by 12 % or € 162.3 million to € 1,208.3 million in the 2023 fiscal year (previous year:€ 1,370.7 million). This figure included negative exchangerate effects of € 25.5 million and positive effects of € 3.6 million from the acquisition of the business activities of Imaginant Inc. in Rochester, New York, on August 15, 2023. Adjusted for this effect, operating sales were down 10 % on the previous year.

The external factors of influence in 2023 described above were reflected in the division’s sales performance. The demanding economic conditions resulted in a substantial decrease in volumes throughout the year, serving as the sole factor behind the decline in sales. Nonetheless, positive price/mix effects partially offset the overall impact. The volume decline impacted all product lines in the Additives division. Conversely, in the Instruments division, slight operating growth was achieved after accounting for exchange-rate and acquisition effects.

In 2023, the regional sales development experienced an overall decline, albeit to varying degrees. Adjusted for exchange-rate and acquisition effects, the previously dynamic Americas region, which saw a double-digit percentage decline in sales similar to the Group as a whole, witnessed this trend in the U.S., the market with the highest overall sales. Canada, Brazil, and other Latin American countries also experienced declines, with only Mexico achieving a slight nominal increase while still facing operating losses. Asia also reflected a cyclical decline in sales, losing a slightly higher double-digit percentage of sales than the Group overall when adjusted for exchange-rate and acquisition effects. China, the leading sales market in Asia, continued to lose momentum and, in contrast to the Group, experienced sales losses in the lower double-digit percentage range. In contrast, the sales market in India showed a very positive development, achieving double-digit growth that surpassed the Group’s overall growth. Adjusted for exchange-rate and acquisition effects, Europe experienced a mid single-digit percentage decline in sales in 2023 but replaced the Americas and Asia as the region with the highest sales. The countries of the European Union also recorded an overall operating sales loss in the mid single-digit percentage range. Germany suffered a disproportionately high loss compared to most other European markets, with positive operating growth rates only observed in some Eastern European countries.

Sales Performance of ECKART

The ECKART division generated sales of € 351.1 million in 2023 (previous year: € 396.8 million). The year-over-year decline of 12 %, negatively impacted by exchange-rate effects, amounted to 10 % in operational terms. The external factors described above also impacted demand in the ECKART division. The decline in volume was only slightly offset by slightly positive price / mix effects.

At regional level, sales performance in 2023 declined in all key markets. Europe, the region with the highest sales and Germany as the leading market, recorded a loss in the upper single-digit percentage range adjusted for exchange-rate effects. Asia achieved operating growth, particularly in the markets of Japan and South Korea. Demand declined in all other markets, especially in China, the market with the highest sales, and the entire region suffered sales losses in the low double-digit percentage range after adjusting for foreign exchange. The Americas, which showed the greatest sales momentum in the previous year, faced the biggest percentage loss in 2023 after exchange-rate adjustments. The decline in sales was evident in all markets in the region, resulting in an overall operating sales drop in the low double-digit percentage range, mainly due to the development in the U.S., the market with the highest sales. The markets in Canada, Brazil, and Mexico showed disproportionately weak momentum in 2023, with exchange-rate-adjusted sales decreases of over 20 % in some cases.

Sales Performance of ELANTAS

In the ELANTAS division, sales in 2023 decreased by 2 % or € 12.5 million to € 685.7 million (previous year: € 698.2 million). Operating sales growth amounted to 5 %, adjusted for negative exchange-rate effects € 28.5 million and positive effects of € 54.1 million from the acquisition of the Von Roll Group on September 29, 2023. ELANTAS was the only division to exhibit a slightly positive operating sales trend in volumens in 2023. However, the volume growth was unable to compensate for the price reductions that were passed on to customers due to the fall in raw material prices.

A look at the regions shows a very mixed picture. China, the strongest individual market in terms of sales, continued to lose momentum in 2023. Adjusted for exchange-rate and acquisition effects, the country experienced a price-related decline in sales in the mid single-digit percentage range. In contrast, India, the second-strongest market in the region, continued to develop dynamically with an operating percentage growth rate at the same level. However, the Asia region lost sales, adjusted for exchange-rate and acquisition effects, in the mid single-digit percentage range. Europe also experienced a decline in operating sales in the low single-digit percentage range in this division. While the two largest markets, Italy and Germany, among others, saw reductions in operating sales, various countries in Eastern Europe significantly increased sales in percentage terms. In nominal terms, the ELANTAS division achieved substantial sales growth in this region, particularly due to the acquisition of the Von Roll Group. The Americas region performed the weakest in the ELANTAS division, with only Canada achieving sales growth in the low single-digit percentage range. All other markets, including the leading market of the U.S., lost ground, in some cases significantly, and the region as a whole reported a fall in sales in the low double-digit percentage range after adjusting for exchange-rate effects and acquisitions.

Sales Performance of ACTEGA

With sales of € 496.5 million (previous year: 555.3 million), the ACTEGA division lost 11 % in sales compared to 2022. Adjusted for negative currency effects of € 2.9 million, operating sales development amounted to -10 %. The main reason was the ongoing cyclical decline in volumes over the course of 2023. In addition, price reductions were recorded in this division due to lower raw-material prices.

In 2023, the division’s sales performance was marked by volume losses across all regions. In Europe, the region with the highest sales, the operating sales loss was in the upper singledigit percentage range. The Eurozone, as a whole, experienced a significant loss of momentum. Germany, the market with the highest sales, suffered a disproportionately high drop in sales. Sales growth was only achieved in some Eastern European countries and Sweden in 2023. The Americas also faced sales losses across all markets in 2023, resulting in an overall decline in the upper single-digit percentage range after adjusting for exchange-rate effects. In the U.S., the market with the highest sales, there was a moderate decline in the low single-digit percentage range, while sales in Brazil were almost maintained. However, other countries in the region, particularly Mexico, saw a significant percentage drop in sales. The Asia region recorded the weakest sales development in percentage terms.

Earnings Situation

ALTANA’s earnings situation in 2023 was predominantly influenced by the sharp decline in demand due to the challenging economic conditions. Although the cost of materials and energy experienced a slight decrease compared to the previous year, the ratios in relation to sales remained high in comparison to the long-term average. Earnings were negatively affected by increases in personnel expenses and consistently high freight costs, along with substantial one-off costs associated with multiple acquisitions and strategic projects. In total, absolute earnings before interest, taxes, depreciation, and amortization (EBITDA) declined by 15 %, or € 67.1 million, amounting to € 385.1 million, which was below the previous year’s result 452.2 million. Adjusted for acquisition and exchange-rate effects, the operating decline was 12 %. The EBITDA margin stood at 14.0 %, lower than the previous year’s figure of 15.0 % and below the strategic target range of 18 % to 20 %. As a result, the targeted increase in absolute earnings in the upper singledigit percentage range and the expected improvement in the EBITDA margin could not be achieved, primarily due to the volume-related decline in sales. Despite these challenges, comprehensive cost-cutting measures initiated at the beginning of 2023 and gradually expanded throughout the year allowed us to stabilize the absolute result.

The most important cost parameter for ALTANA, variable raw-material and packaging costs, remained at a high level overall in 2023. The material usage ratio, the ratio of these costs to sales, was 46.1 % in the first quarter and developed with slight fluctuations to 46.3 % by the fourth quarter. For 2023 as a whole, the material usage ratio was 46.5 %, below the previous year’s figure of 48.9 % and lower than we had forecast. The material costs developed differently in the four divisions. While ELANTAS and ACTEGA benefited from the decline in raw-material prices, the cost of materials ratios in the BYK and ECKART divisions were slightly higher on average than in the previous year.

In 2023, cost trends no longer showed the significant increase of the previous year. Inflation experienced a slight decline, while energy and freight costs remained elevated compared to the long-term average. Notably, personnel costs saw a significant rise, driven by inflation-related catch-up effects. Besides wage increases, the acquisition of the Von Roll Group, with the assumption of 982 employees at the end of 2023, temporally impacted personnel costs in absolute terms. The ratio of total personnel costs to sales increased to 22.7 % (compared to 19.7 % in the previous year) due to the decline in sales. Depreciation and amortization increased by 2 % in a year-to-year comparison.

Within production costs, personnel costs in particular were higher than in the previous year due to the increase in staff resulting from the acquisition of the Von Roll Group, while energy costs and other variable cost components fell due to the decline in the volume produced.

The absolute decline in selling expenses is mainly due to lower sales compared to the previous year. Freight costs and other volume-related costs such as sales bonuses fell significantly. Depreciation and amortization also fell in the realm of selling expenses. Travel expenses, on the other hand, increased overall in this cost area.

In 2023, ALTANA again increased its research and development expenses. The reasons for the increase were, on the one hand, the integration of the Von Roll Group’s research and development activities and, on the other, an increase in personnel costs. The ratio of research and development costs to total sales increased from 6.4 % to 7.2 % in 2023 and was thus in line with our target of around 7 %.

Administrative expenses increased the most compared to the previous year. The main reason was the costs associated with the strategic projects and the acquisitions made in preparation. Increases in personnel costs and higher travel expenses were also a contributing factor. The ratio of administrative expenses to sales rose to 5.2 %, higher than the previous year’s level of 4.4 %.

The positive balance of other operating income and expenses totaled € 11.1 million in 2023, higher than the previous year’s figure (€ 8.5 million). This figure was positively impacted by one-off special income from the reversal of a provision as a risk provision for possible bad debts. Earnings before interest and taxes (EBIT) amounted to € 216.3 million, 19.3 % down on the previous year’s figure (€ 287.5 million) in operational terms.

At € - 7.1 million, the financial result was below the previous year’s figure of € 7.0 million. This is partially because net interest developed negatively in 2023 due to higher employee benefit obligations. The previous year’s balance also included income from the sale of shares in dp polar GmbH, Eggenstein-Leopoldshafen. The result from companies accounted for using the equity method changed from € 10.9 million in the previous year to € - 43.0 million in 2023. The reason for the positive prior-year figure were valuation effects in connection with the investment in Landa Corporation Ltd. following a capital increase by a third-party investor.

Earnings before taxes (EBT) fell to € 166.3 million (previous year: € 305.5 million), while earnings after taxes (EAT) decreased to € 110.2 million (previous year: € 232.4 million). At 27 %, the adjusted income tax rate was higher than in the previous year (25 %).

Asset and Financial Situation

Capital Expenditure

In 2023, € 10.0 million were attributable to subsequent payments in connection with the technology acquisition at ACTEGA in 2017. Adjusted for this payment, ALTANA invested a total 138.3 million in intangible assets and property, plant and equipment in the past fiscal year, thus exceeding the previous year’s figure (€ 103.5 million). The investment ratio, that is the ratio of investments to sales, was 5.0 % and thus within our long-term target range of 5 % to 6 %.

Of the € 138.3 million invested, € 122.7 million related to property, plant and equipment (previous year: € 95.0 million). For several years, major projects have been carried out to strategically expand global production and laboratory capacities. Investments in intangible assets totaled € 15.6 million in the past fiscal year, compared to € 8.5 million in 2022. The focus of investments was on the further expansion of digitalization and ERP systems.

In the regional distribution of investments, there were project-related shifts compared with the previous year. While Europe’s share fell from 56 % in 2022 to 50 % in the reporting year, Asia’s share grew to 16 % (previous year: 10 %). This increase was mainly due to investment projects in China. Amounting to 34 % of the total volume, the America’s share remained at the previous year’s level. At 32 %, the focus of investment activity in the reporting year was in the U.S. Investments in Germany decreased to a proportion of 30 %.

The BYK division invested a total of € 60.0 million in 2023, significantly above the previous year’s level (€ 41.5 million). Investment activities focused on the further expansion of production capacities in the U.S. and Germany. Other investments concerned research and development capacities as well as strategic digitalization projects.

At € 16.3 million, the ECKART division’s investment volume was lower than in the previous year (€ 22.3 million). As in the prior year, the division’s site in Hartenstein and its sites in the U.S. accounted for by far the largest shares.

The ELANTAS division increased its investments in property, plant and equipment and intangible assets to € 38.7 million (previous year: € 16.4 million). In the past fiscal year, the division invested primarily in the production facilities at its site in Zhuhai, China, and those of its European companies.

Investments in the ACTEGA division amounted to € 19.0 million (previous year: € 20.7 million). Investments in the past fiscal year mainly related to the expansion of production capacities at German sites and its U.S. site in North Carolina.

Balance Sheet Structure

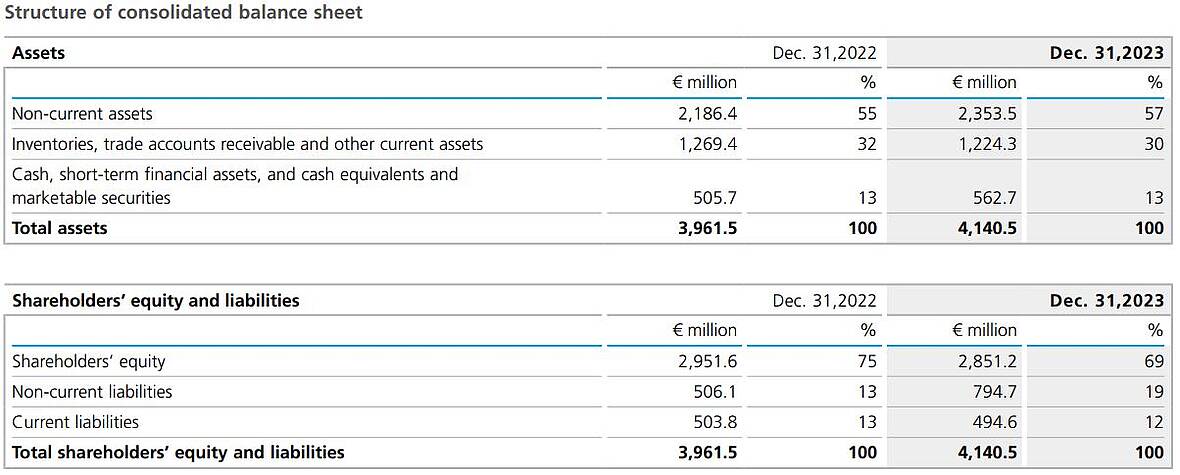

At the end of 2023, the balance sheet structure was significantly influenced by the inclusion of the Von Roll Group in the scope of consolidation. The ALTANA Group’s total assets rose from € 3,961.5 million in the previous year to € 4,140.5 million in 2023. The increase € 179.0 million or 5 % results primarily from an increase in non-current assets from this acquisition. Negative exchange-rate effects also impacted the balance sheet total.

Intangible assets increased to € 1,033.8 million (previous year: € 986.2 million). Property, plant and equipment also increased in value, from € 1,012.3 million in the previous year to € 1,147.0 million. With additions € 122.7 million, the level of investment in property, plant and equipment was higher than the level of depreciation and amortization. Negative exchange-rate effects contributed to a decrease in the carrying amounts in the Group currency, the euro, in both areas.

Total non-current assets amounted € 2,353.5 million at the balance sheet date (previous year: € 2,186.4 million), up € 167.1 million on the previous year, mainly due to acquisitions. Their share of total assets increased to 57 % (previous year: 55 %).

The change in current assets was mainly due to the decrease in inventories and a slight increase in cash and cash equivalents. Despite the acquisition of the Von Roll Group, inventories fell significantly to € 561.8 million over the course of the year (previous year: € 616.5 million). Trade receivables also declined, only exceeding the previous year’s figure due to the expansion of the scope of consolidation. At € 505.8 million, trade receivables were higher than in the previous year (€ 487.6 million). At € 853.1 million, the scope of net working capital and current trade payables was below the level at the end of 2022 (€ 871.8 million). The scope of net working capital, in relation to the business performance of the preceding three months, fell slightly to 132 days, compared to 138 days at the end of 2022. Absolute net working capital at the end of 2023 was slightly below the forecast value, despite the acquisition of the Von Roll Group. Nevertheless, the expected decline in the range was not fully achieved, as the development of inventory values was mainly due to the reduction in business activities. Cash and cash equivalents increased to € 491.3 million over the course of the year (previous year: € 458.1 million), primarily resulting from the inflow from non-current financial liabilities. As a result, total current assets rose slightly to € 1,787.0 million (previous year: € 1,775.0 million).

On the liabilities side, changes resulted primarily from dividend payments, increases in non-current financial liabilities, an increase in pension provisions, and exchange-rate-related adjustments. The Group’s equity decreased by a total of € 100.4 million or 3 % to € 2,851.2 million (previous year: € 2,951.6 million). The positive result for the year was more than offset by dividend payments and negative currency and pension valuation effects. At 69 %, the equity ratio as of December 31, 2023, was below the previous year’s level (75 %).

Total non-current liabilities increased in the course of 2023, mainly due to the extended utilization of a credit line from the European Investment Bank (EIB) in the amount of € 60.0 million and a promissory note loan with a sustainability component placed in November 2023 in the amount of € 180.0 million. In addition, pension provisions increased, mainly due to interest rates. Overall, non-current liabilities increased by € 288.6 million to € 794.7 million (previous year: € 506.1 million).

Total current liabilities reported in the balance sheet on December 31, 2023, fell slightly from € 503.8 million to € 494.6 million. Trade payables decreased slightly by € 17.7 million to € 214.6 million.

The balance of cash and cash equivalents, short-term financial assets, current marketable securities, loans granted, financial liabilities, and employee benefit obligations resulted in net financial assets of € - 51.8 million at the balance sheet date of December 31, 2023. This corresponds to a decrease of € 196.5 million compared with the previous year (net financial assets € 144.7 million), due in particular to the expenses for the acquisitions.

Principles and Goals of Our Financing Strategy

We generally aim to finance our operating business activities from the cash flow from operating activities. The same applies to the need for capital expenditure, which caters to the continual expansion of business activities.

As a result, our financing strategy is oriented to keeping the cash and cash equivalents generated within the Group centralized. In addition, a financing framework is sought that enables ALTANA to flexibly and quickly carry out acquisitions and even large investment projects beyond the accustomed scope.

To successfully implement these goals, we manage nearly all of the Group’s internal financing centrally via ALTANA AG. To this end, cash pools are set up for the important currency areas.

In June 2021, ALTANA restructured its long-term Group financing: Since June 2021, ALTANA has had access to € 250.0 million in the form of a syndicated credit facility from an international bank consortium which has a minimum term until 2026. In 2023, the term was extended until June 2028. As of December 31, 2023, the credit line had not been utilized. In addition, ALTANA has had access to loans from the European Investment Bank (EIB) of up to € 200.0 million since the end of June 2021 for the development of climate-friendly, digital, and sustainable products. In the 2022 fiscal year, the EIB loan commitment was increased by € 50 million to a total of € 250 million and the call period was extended by one year until December 21, 2023. The EIB loans were utilized in the amount € 210.0 million by the end of the call period in 2023. In November 2023, ALTANA issued a promissory note loan with a sustainability component of € 180 million with a minimum term until 2026. The promissory note is divided into tranches with different terms of between three and seven years, which have both variable and fixed interest rates.

This financing structure offers ALTANA the necessary flexibility to make appropriate use of short-term and investment-intensive growth opportunities. The distribution of the maturities of the existing financing instruments enables us to optimally manage the repayment of liabilities via the inflows from operating cash flow.

Off-balance-sheet financing instruments result from bank guarantees, purchasing commitments, and guarantees for pension plans. Details on the existing financing instruments are provided in the Consolidated Financial Statements.

Liquidity Analysis

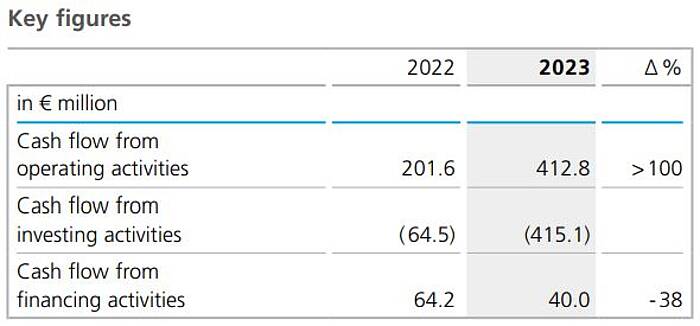

In the course of 2023, cash and cash equivalents increased by € 33.2 million to € 491.3 million (previous year: € 458.1 million). At € 412.8 million, the cash inflow from operating activities was well above the previous year’s 201.6 million) and in line with our expectations, which had forecast an improvement for 2023 compared to the previous year. This primarily reflects the release of capital in net working capital with a reduction € 90.5 million over the course of the year, in particular due to the sharp reduction in inventories.

The cash outflow from investing activities, which includes substantial payments for the acquisitions made, increased significantly compared to the previous year, reaching € 415.1 million (compared € 64.5 million in the previous year). Acquisitions constituted payments of € 223.4 million, with the largest portion by far allocated to the acquisition of the Von Roll Group. Additionally, expenses were incurred for the acquisition of the business activities of Imaginant Inc. Furthermore, investments in intangible assets and property, plant, and equipment also exceeded the previous year’s level.

In the 2023 financial year, there was an inflow of funds from financing activities amounting to € 40.0 million, which was provided by the further utilization of the EIB loan € 60.0 million and the raising of a promissory note loan amounting to € 180.0 million. In the previous year, there was an inflow of funds from financing activities totaling € 64.2 million. In fiscal 2023, ALTANA AG paid a dividend amounting to € 150.0 million (previous year: € 70.0 million).

Value Management

ALTANA determines the change in the company’s value via the key figure ALTANA Value Added (AVA), whose calculation is explained in the “Group Basics” section. In addition, the key figure Return on Capital Employed (ROCE), which is also presented in the “Group Basics” section, is used to measure the development of the company’s value.

The AVA calculation methodology underwent a review in 2022, focusing on the composition of tied-up capital and the calculation of operating income. A significant change was made by discontinuing the longstanding practice of including historical acquisition costs of acquisition values in intangible assets and adjusting depreciation and amortization in income accordingly. The new approach utilizes the corresponding carrying amounts instead of historical acquisition costs. This updated calculation method, offering a more transparent computation and improved management for the operating units, was consistently applied for the first time in 2023. To maintain consistency, the comparative figures for 2022 were adjusted to align with the new logic.

In the 2023 fiscal year, it was not possible to make a positive contribution to the development of the company’s value due to the challenging economic conditions. The value achieved was both below the previous year’s value and significantly below the forecast value.

The key figures for value management in 2023 were also impacted by the company’s acquisition activity. The average operating capital tied up in the Group increased by 5.8 % year over year, reaching € 2,676.1 million (compared to € 2,530.3 million in the previous year). The increase is almost exclusively due to the acquisition of the Von Roll Group, and, to a much lesser extent, the acquisition of the business of Imaginant Inc. This is particularly evident in the rise in property, plant, and equipment, as well as intangible assets.

ALTANA’s earnings development in 2023 was reflected in the operating margins of € 170.3 million (previous year: € 216.1 million). The earnings components for the year, particularly those of the Von Roll Group, were impacted by extensive acquisition and integration costs as well as one-off negative effects from the revaluation of acquired inventories. Overall, the aforementioned influences on EBIT led to a relatively low earnings base compared to increased operating capital. The cost of capital rate remained unchanged at 7.5 %, resulting in costs of capital of € 200.7 million (previous year: € 189.8 million).

At 6.4 %, the return on capital employed (ROCE) in 2023 was down on the previous year’s figure (8.5 %). Absolute value added totaled € - 30.4 million in the past fiscal year, compared to € 26.3 million the year before. Relative AVA fell from 1.0 % in the previous year to - 1.1 % in 2023. The originally forecast significant increase in the value management key figures was not achieved due to both the earnings situation, which was adversely affected by the external environment, and the unplanned acquisitions.